|

|

|

|

|

| 1 | Promsvyazbank | 4.87 | Better conditions, "loan holidays" |

| 2 | Moscow credit bank | 4.85 | Longest loan term |

| 3 | Rosbank | 4.82 | The best conditions for life insurance |

| 4 | Home Credit Bank | 4.80 | Issuance of a loan only by passport |

| 5 | Raiffeisenbank | 4.76 | The fastest loan decision |

| 6 | Rosselkhozbank | 4.73 | The most convenient payment system |

| 7 | Sberbank | 4.72 | Better Reliability |

| 8 | Alfa Bank | 4.70 | No imposed insurance |

| 9 | VTB | 4.69 | The largest number of refinanced loans |

| 10 | Gazprombank | 4.66 | Possibility to increase the maximum amount |

| 11 | Tinkoff Bank | 4.60 | The possibility of refinancing microloans |

| 12 | Post Bank | 4.57 | The most interesting offers |

| 13 | Uralsib | 4.55 | Without references for refinanced loans |

| 14 | Opening | 4.48 | |

| 15 | MTS Bank | 4.45 |

Refinancing allows you to combine several loans into one in order to be able to increase the loan repayment period or reduce the interest rate. It is not available to every client, but it is a good opportunity to reduce the burden and make life easier for yourself. It is worth remembering that refinancing is a targeted allocation of funds to repay other cash loans. Therefore, you will have to account for every ruble. Especially for you, we have compiled a rating of the best banks for refinancing loans. It includes financial institutions offering the most favorable conditions.

Top 15. MTS Bank

- Founded: 1993

- Website: mtsbank.ru

- Phone: 8 (800) 250-05-20

- Amount: from 20,000 to 5,000,000 rubles.

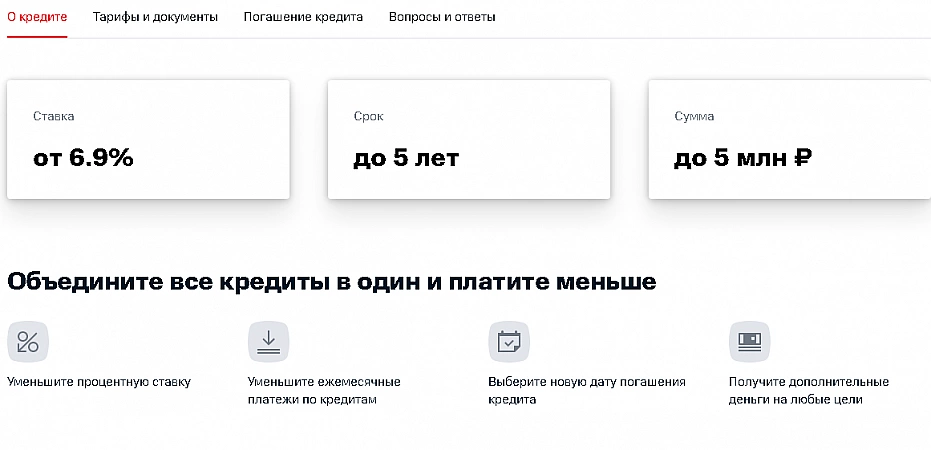

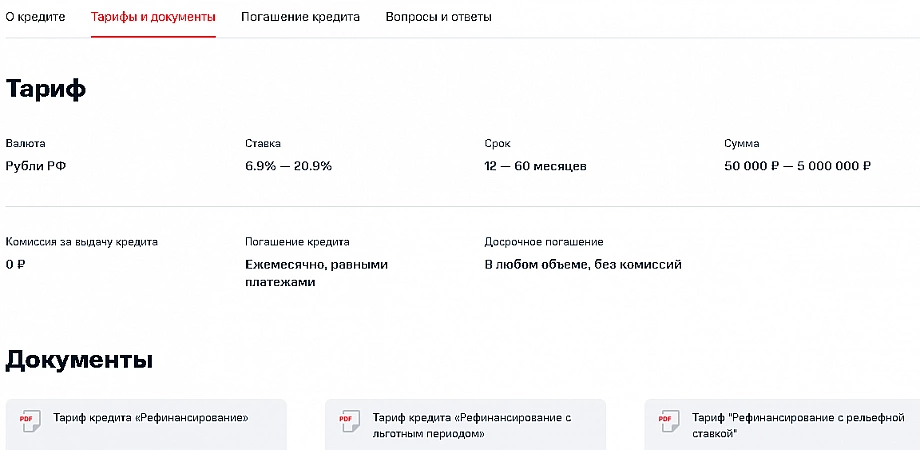

- Interest rate: from 6.9 to 20.9%

- Maximum term: 5 years

MTS Bank provides refinancing at a rate of 6.9% per annum without any requirements such as salary or minimum amount. The bank is able to issue such a percentage even for a minimum loan with a short repayment period and earn practically nothing on it. But the maximum loan rate, however, is not encouraging: it can rise to 20.9%, depending on the individual calculation. And the individual calculation depends on many factors, which is not very encouraging. MTS is poor on documents and explanations of conditions. It is known that the institution offers from 50 thousand to 5 million rubles for a period of 1-5 years. Refinancing can include credit cards, purchases, auto loans, and cash loans.

- Small minimum interest rate, from 6.9% per annum

- You can apply for a small amount up to 20,000 rubles

- Many options for paying a loan - online, terminals, ATMs, MTS

- The interest rate is calculated individually, up to 20.9%

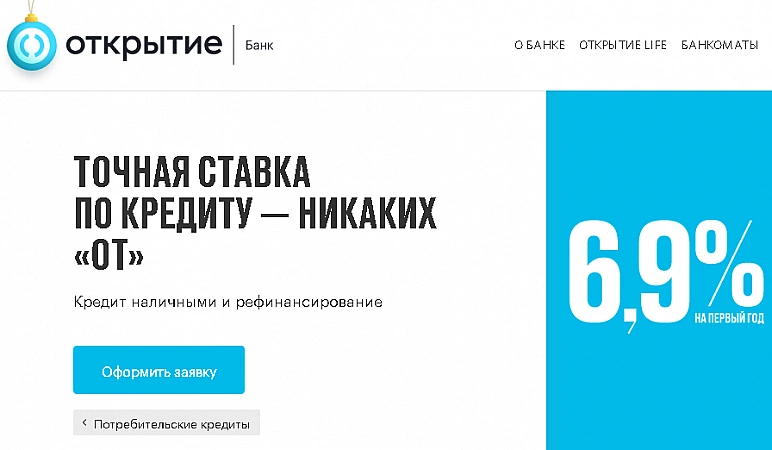

Top 14. Opening

- Founded: 1992

- Website: open.ru

- Phone: 8 (800) 444-44-00

- Amount: from 50,000 to 5,000,000 rubles.

- Interest rate: from 5.9 to 21.9%

- Maximum term: 5 years

Before applying for refinancing in this bank, you should carefully study the conditions. For example, for borrowers who already use the services of a financial institution, the rate will be attractive - from 5.9%. For those who apply for the first time and take a large amount, the overpayment in the first year will be a fixed 6.9%, then from 7.9%, but taking into account the connected insurance.Customers who refuse additional services can expect a rate of 12.9% to 21.9% if they take less than 300,000 rubles, and from 11.9% to 17.5% when making a large amount. But there are also pluses - the bank provides a free debit card with cashback, and all income is taken into account when considering, which increases the likelihood of approval.

- Low value of the minimum rate, from 5.9%

- Free debit card with cashback

- All income counts, more likely to be approved

- Extra money for personal needs

- You can not do without certificates, you need to collect a package of documents

- When issuing less than 300,000 rubles without insurance, the rate is up to 21.9%

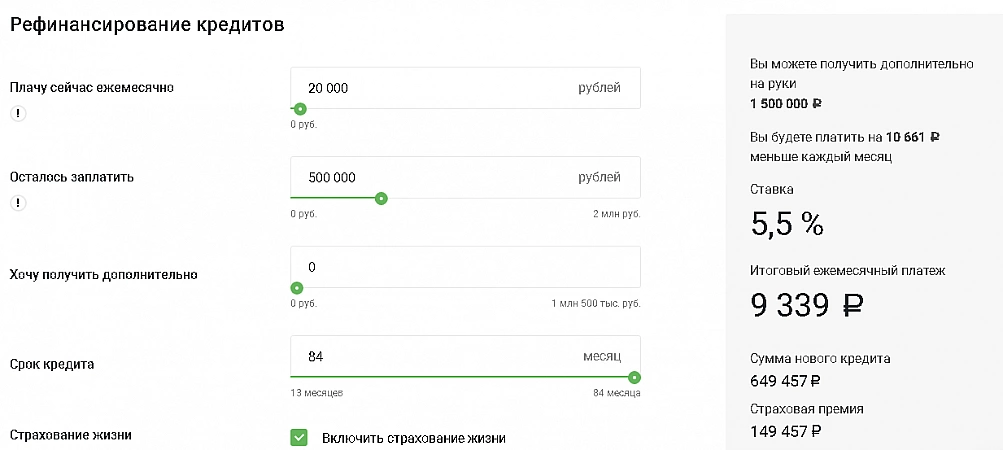

Top 13. Uralsib

You do not have to collect a large package of documents to obtain approval. The bank checks all data on refinanced loans independently.

- Founded: 1993

- Website: www.uralsib.ru

- Phone: 8 (800) 250-57-57

- Amount: from 100,000 to 2,000,000 rubles.

- Interest rate: from 5.5 to 16.9%

- Maximum term: 7 years

Uralsib Bank offers good conditions for those who are ready to take out life and health insurance. In this case, the interest rate will be quite low, from 5.5%. In case of refusal of insurance, it can reach 16.9%. The payment term can be extended over 7 years. But compared to most other banks, Uralsib is not ready to exceed the amount of 2,000,000 rubles, as well as refinance loans issued for business development. For people who have a lot of debt, this may not be enough.In addition to refinancing existing loans, as in most banks, here you can get an additional amount for any needs on quite favorable terms.

- No need to submit documents for refinanced loans

- Low interest rate life insurance

- A new loan can be concluded for up to 7 years

- Opportunity to receive additional funds

- Without life insurance interest rate up to 16.9%

- Does not refinance loans for business development

- The maximum amount is only 2000000 rubles

Top 12. Post Bank

Post Bank makes really interesting offers. For example, you can activate the Zero Doubts promotion to get a grace period, reduce the amount of payments and increase the payment period.

- Year of foundation: 2016

- Website: pochtabank.ru

- Phone: +7 (495) 532-13-00

- Amount: from 50,000 to 4,000,000 rubles.

- Interest rate: from 5.9 to 11.9%

- Maximum term: 5 years

Post Bank offers loan refinancing on quite acceptable terms at a rate of 5.9 to 11.9%. This may include any consumer or auto loans. But keep in mind that Post Bank does not refinance loans issued by financial institutions of the VTB Group. The offer is especially beneficial for bank debit card holders. By paying her purchases from 10,000 rubles a month, you can reduce the interest rate by as much as 2%. In addition, the action "Zero Doubts" is offered. By connecting it, you can get a grace period for 3 months without charging interest, and in the future, making payments of only 0.5% of the loan amount with an increase in the repayment period by 4 months. But for this, an insurance contract must be drawn up.

- Profitable refinancing for Post Bank cardholders

- A unique offer - the action "Zero Doubts"

- Low interest rate, from 5.9 to 11.9%

- Additional funds available

- Loans of VTB Group banks are not refinanced

- To reduce the rate, it is necessary to draw up an insurance contract

Top 11. Tinkoff Bank

This is the only bank that allows you to include in the refinancing program not only consumer loans and mortgages, but also loans received from microfinance organizations.

- Year of foundation: 2006

- Site: tinkoff.ru

- Phone: 8 (800) 755-46-64

- Amount: from 50,000 to 2,000,000 rubles.

- Interest rate: from 9.9 to 24.9%

- Maximum term: 3 years

Tinkoff Bank allows you to take a loan for refinancing from 50 thousand to 2 million rubles. Payments can be made over a period of 1 to 3 years. The rate varies from a minimum of 9.9% to 24.9%. Moreover, it is not known what exactly the annual percentage depends on. But it is convenient that the bank allows you to refinance even microloans, which many institutions simply do not agree to: in this case, the rate of 24.9% even looks justified compared to interest on microloans. The conditions state that it is possible to repay "all active loans" of the client. Tinkoff can boast of excellent service: it is enough to apply online only with a passport, after which the bank will check everything on its own, and the money and documents will be brought literally to the doorstep. Moreover, a separate Tinkoff Black card will be issued for the issuance of money.It should be borne in mind that, judging by the reviews, Tinkoff Bank is not too loyal to people with small salaries or delays: in this case, it is easy to get a refusal.

- Ease of registration, everything is online, the courier brings the card and documents

- You do not need to collect certificates, just fill out an application

- You can refinance a mortgage, any loans and microloans

- Incomprehensible system for forming an individual rate

- High interest compared to many other banks

- Maximum term up to 3 years, high monthly payment

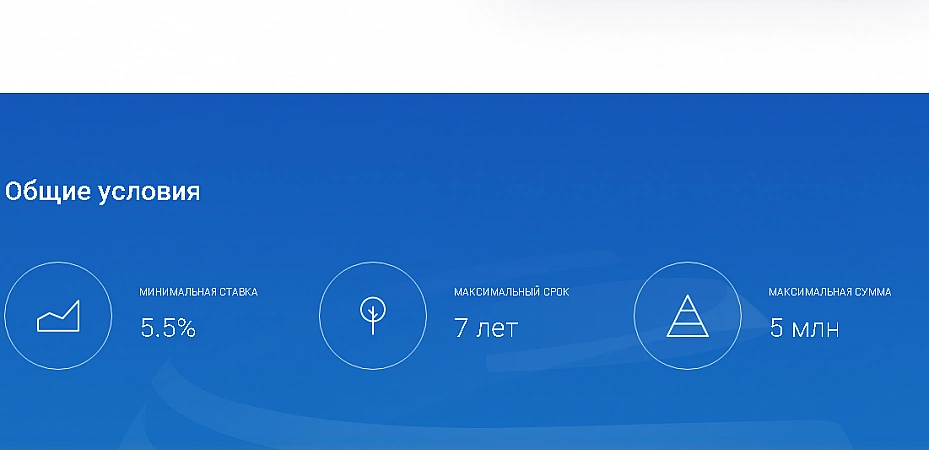

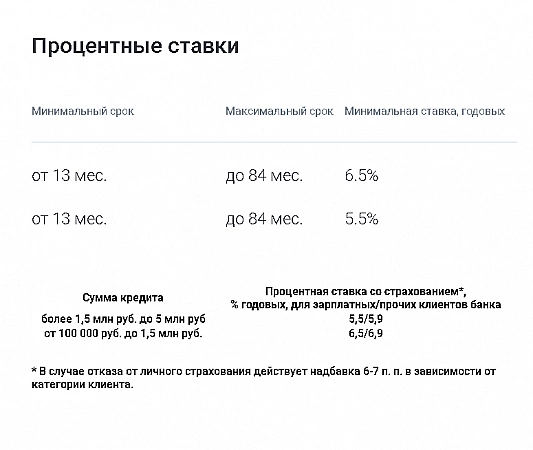

Top 10. Gazprombank

If a legal entity vouches for the client, it is possible to receive an amount greater than the upper limit, exceeding 5,000,000 rubles.

- Founded: 1990

- Website: gazprombank.ru

- Phone: 8 (800) 100-07-01

- Amount: from 100,000 to 5,000,000 rubles.

- Interest rate: from 5.5 to 13.9%

- Maximum term: 7 years

Gazprombank is ready to include in the offer from 100,000 to 5 million rubles for refinancing loans. Time to repay - from 13 months to 7 years. The interest rate starts from 5.5%. However, this rate is set for people who necessarily insure the loan. Otherwise, you will have to do with the rate of 13.9%. Gazprombank boasts the best loan calculator. Literally everything can be calculated from it - from the required amount to the amount of overpayment on a loan at a bank. In addition, it allows you to find out the required minimum income or calculate the possible limit depending on the requirements and income of the client. It is very convenient and helps to understand what to expect from the bank in the final decision. Interestingly, the bank is ready to accept a guarantee for individuals legal entities.At the same time, the size of the credit limit can be increased if a legal entity offers a larger guarantee amount than its upper limit.

- Low minimum interest rate from 5.5%

- Long term loan repayment, up to 7 years

- The possibility of increasing the loan amount above the upper bar

- Convenient calculator on the bank's website

- Low rate only subject to credit insurance

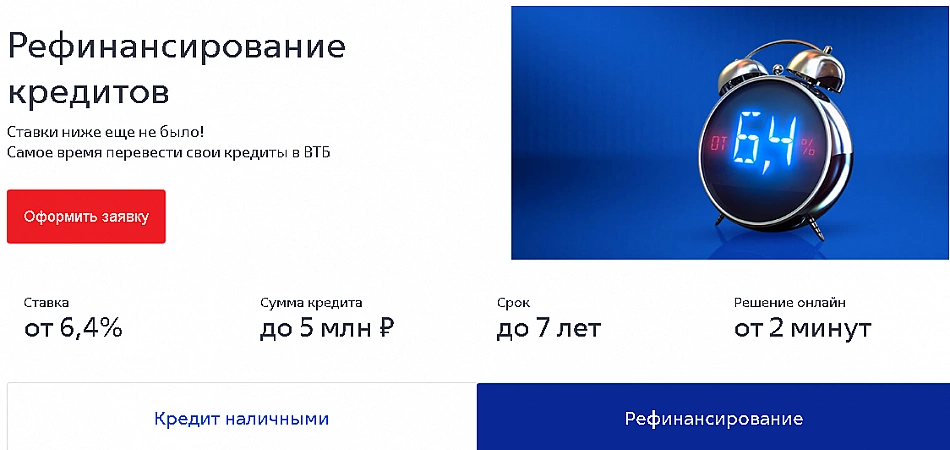

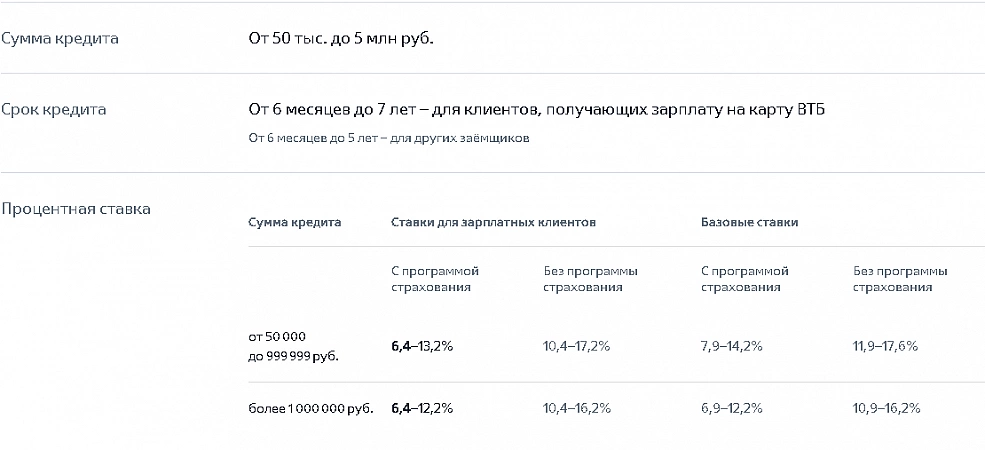

Top 9. VTB

VTB is ready to help clients refinance up to 6 different loans. This is convenient for people who have a large amount of debt.

- Founded: 1990

- Website: vtb.ru

- Phone: 8 (800) 100-24-24

- Amount: from 50,000 to 5,000,000 rubles.

- Interest rate: from 7.4 to 17.6%

- Maximum term: 7 years

VTB offers a favorable rate of 7.4%. There are a lot of positive things about the bank in the customer reviews. It allows you to take from 50 thousand to 5 million rubles and return them within 7 years. And also combine the most loans and credit cards - up to 6. So ideal for those who have a lot of debt. It is important to remember that the institution does not refinance loans taken from VTB Group banks, not counting its own loans. More favorable conditions are offered for repayment terms for corporate or payroll clients - they have an additional two years to return the money and the rate of 7.4% applies to them. For the rest, it starts from 7.9% subject to the insurance program. It is also convenient that VTB allows you to take an additional loan “on hand” as part of refinancing, for which you do not need to report.

- Favorable conditions for payroll clients

- Refinancing of a large number of loans, up to 6

- Opportunity to receive additional funds for personal needs

- The maximum refinancing amount is up to 5,000,000 rubles

- Debt repayments within 7 years for payroll clients

- Need to take out insurance to reduce the rate

- Conditions for ordinary clients are worse than for payroll clients.

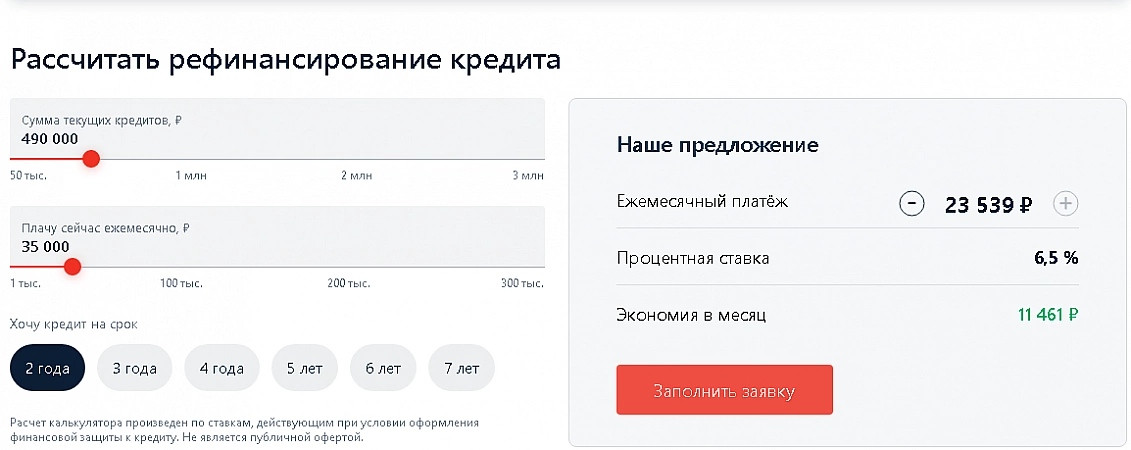

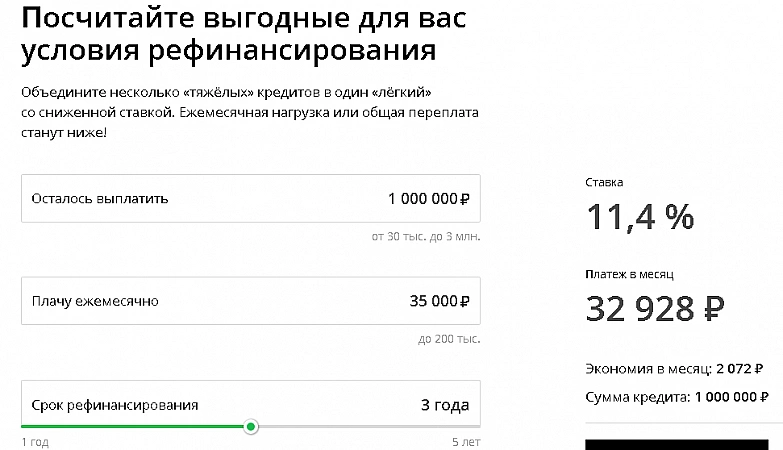

Top 8. Alfa Bank

The purchase of insurance in this bank does not affect the rate in any way. Therefore, it is not necessary to complete it.

- Founded: 1990

- Site: alfabank.ru

- Phone: 8 (800) 200-00-00

- Amount: from 50,000 to 3,000,000 rubles.

- Interest rate: from 6.5 to 13.99%

- Maximum term: 7 years

Alfa-Bank offers quite favorable and convenient conditions for refinancing. The institution allows you to receive an amount from 50 thousand to 3 million rubles for up to 7 years. You can refinance up to five loans or credit cards. The bank allows you to receive part of the funds in cash for your own needs, and not just for closing the refinancing. I am glad that Alfa-Bank does not force customers to purchase insurance - the annual rate does not depend on it. The minimum interest rate is 6.5%, the maximum is 13.99%, it is determined individually according to a number of parameters. The maximum loan amount up to 3,000,000 rubles is available only to payroll clients, all others can count on 1,500,000 rubles and for up to 5 years.

- Reasonable minimum rate from 6.5%, calculated individually

- No need to purchase insurance, does not affect the rate

- Additional funds for any needs other than refinancing

- For non-salary clients, the maximum amount is only 1,500,000 rubles

Top 7. Sberbank

Sberbank has been tested by time and a huge number of customers. Therefore, despite the high annual rate, reliability makes it one of the best.

- Founded: 1981

- Website: sberbank.ru

- Phone: +7 (495) 500-55-50

- Amount: from 30,000 to 3,000,000 rubles.

- Interest rate: from 11.9 to 16.9%

- Maximum term: 5 years

Sberbank is a reliable, time-tested bank. But in exchange for confidence in his honesty, he offers not the most profitable refinancing program. The minimum percentage starts from 11.9%, subject to registration of the amount from 1,000,000 rubles. If you borrow less than 300,000 rubles, the rate can be up to 16.9%. The maximum period for which payments can be stretched is 5 years. In addition to covering loans, you can receive an amount for any other expenses. It is convenient that customers do not have to visit the office, everything can be arranged independently through Sberbank-Online. Making a decision in this case can take from 2 minutes to 2 days.

- You can refinance a small amount from 30,000 rubles

- Opportunity to receive additional funds

- It is not necessary to visit the bank, you can apply in Sberbank-Online

- High interest rate, from 11.9%

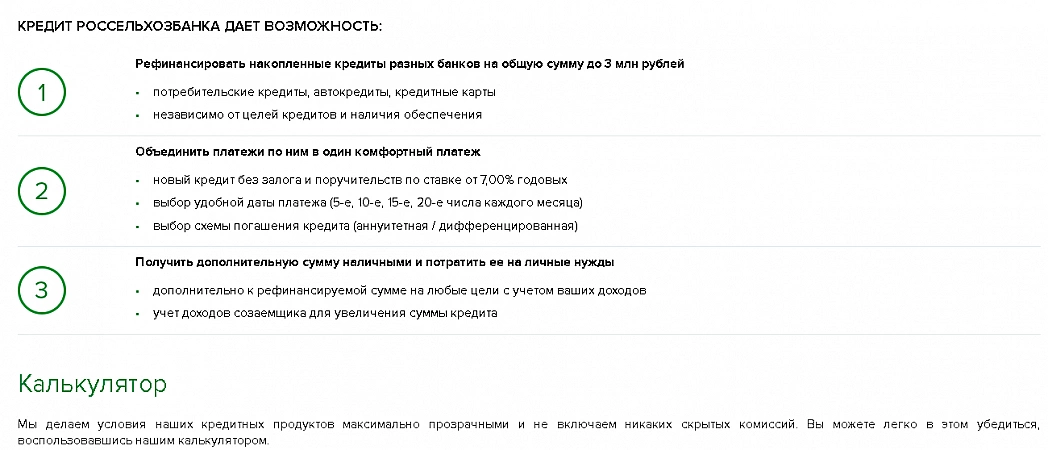

Top 6. Rosselkhozbank

Rosselkhozbank offers customers a choice of four payment dates. You can choose the most convenient, dropping out at the time of receiving wages.

- Year of foundation: 2000

- Site: rshb.ru

- Phone: 8 (800) 100-01-00

- Amount: from 30,000 to 3,000,000 rubles.

- Interest rate: from 7 to 15.5%

- Maximum term: 7 years

Rosselkhozbank allows you to take from 30 thousand to 3 million rubles.But only public sector employees who have taken out personal insurance and applied online can count on the minimum rate of 7%. The money must be returned within 5 years. The bank is ready to provide the best conditions to public sector employees and payroll clients. It is necessary to return the funds within 7 years for "reliable", salary clients and state employees. Unfortunately, only three loans can be refinanced, so this option is not suitable for clients who are literally overgrown with debts. But Rosselkhozbank allows you to choose one of four payment days in a month. An important nuance is that you can increase the loan amount for refinancing at the expense of co-borrowers' debts. It is unpleasant that the loans selected for refinancing should not be restructured or prolonged earlier.

- Favorable conditions for public sector employees

- Choice of one of four payment dates

- Receiving an additional amount in addition to covering loans

- Minimum rate of 7% subject to a number of conditions

- Flexible loan repayment terms, from 6 months to 7 years

- You can refinance up to three loans

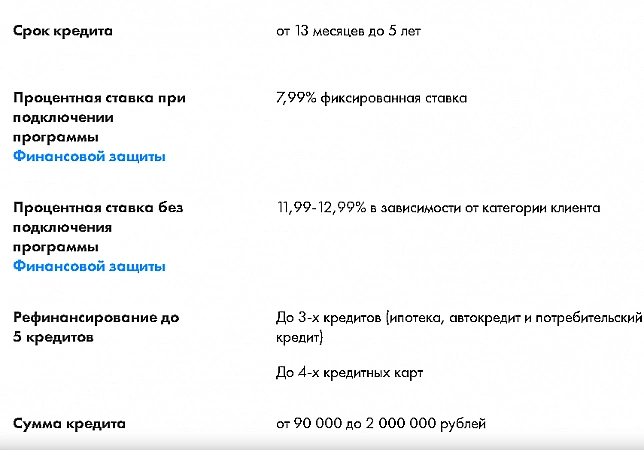

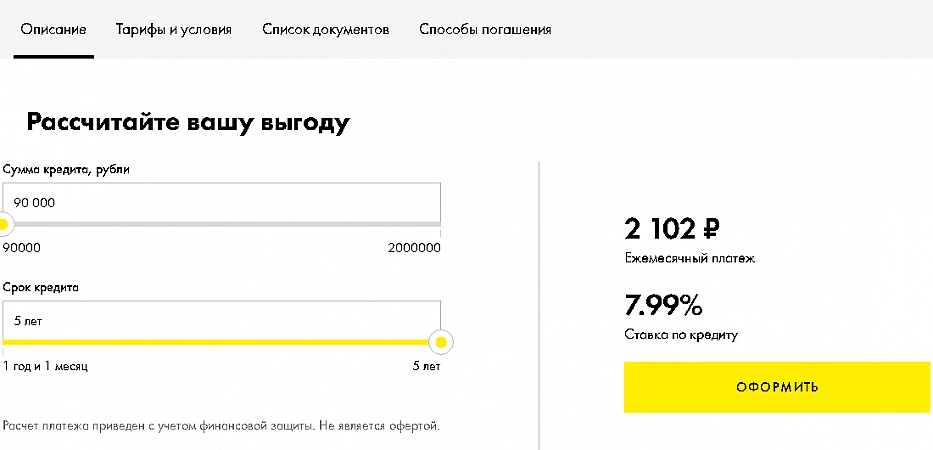

Top 5. Raiffeisenbank

The decision to refinance loans here is made really very quickly. The bank gives an answer on the same day.

- Founded: 1996

- Website: www.raiffeisen.ru

- Phone: 8 (800) 700-91-00

- Amount: from 90,000 to 2,000,000 rubles.

- Interest rate: from 7.99 to 12.99%

- Maximum term: 5 years

Raiffeisenbank offers not the largest amount - from 90 thousand to 2 million rubles. But on the other hand, it allows you to refinance a loan without the consent of the current lender and receive additional money for consumer needs.It must be returned within at least 13 months. The maximum term is 5 years. The minimum rate is available to those who take part in the financial protection program. Otherwise, you will have to overpay at an annual rate of up to 12.99%. The bank promises to consider an application for a loan within two minutes, although in fact this process takes longer. Raiffeisenbank allows you to get refinancing for a maximum of five loans. It is impossible to get refinancing of the same type of loans: among the selected ones there should not be more than three ordinary loans (consumer, targeted, and so on) or more than four credit cards. Alas, the loan is not available for individual entrepreneurs, owners of law offices and business owners.

- Low interest rate subject to certain conditions

- Fast processing of the application, just a few minutes

- Refinancing allows you to cover up to 5 loans

- There is a possibility of receiving additional money

- Loan refinancing is available only to individuals

- High rate without a financial protection program

Top 4. Home Credit Bank

If you want to do without certificates when applying for refinancing, you should contact Home Credit Bank. Here are the minimum document requirements.

- Founded: 1990

- Website: homecredit.ru

- Phone: +7 (495) 785-82-25

- Amount: from 10,000 to 3,000,000 rubles.

- Interest rate: from 7.9 to 23.5%

- Maximum term: 5 years

Home Credit Bank offers a refinancing program at a rate of 7.9%. This is not the most favorable percentage on the market, but other conditions make lending affordable for many people.The minimum rate depends on many parameters, so ideally you should provide a full set of documents to get a low percentage. You can get from 10,000 to 3 million rubles, which is convenient for repaying small amounts, since many banks are ready to issue at least 50 thousand rubles. Payments can be made over a period of five years. It is convenient that you can get a loan only by passport, without resorting to the collection of other documents and certificates. Although this will ultimately lead to a lower chance of approval. In addition, “old” customers of Home Credit Bank can apply online and not leave their homes at all: everything will happen remotely. But new customers will have to go to the office and do everything on the spot.

- High percentage of loan approval for refinancing

- Amount from 10,000 rubles, convenient for repaying small loans

- Online registration for bank customers

- Can be issued for long periods of up to 5 years

- Additional certificates are not always required, only a passport

- There are offers on the market with lower interest rates

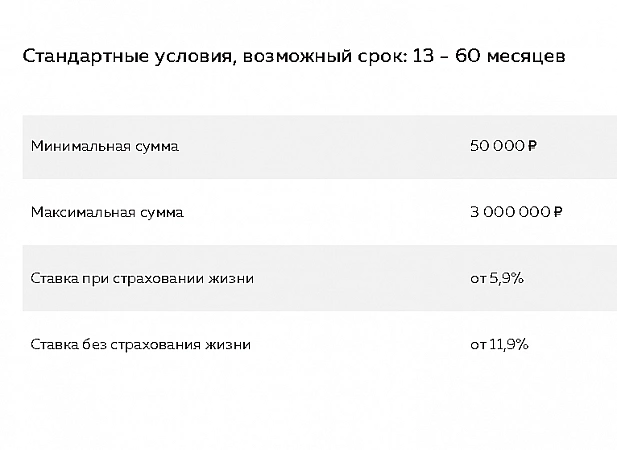

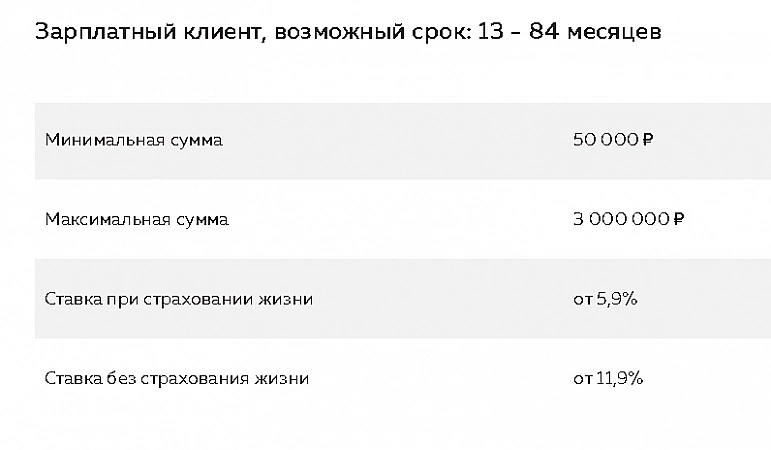

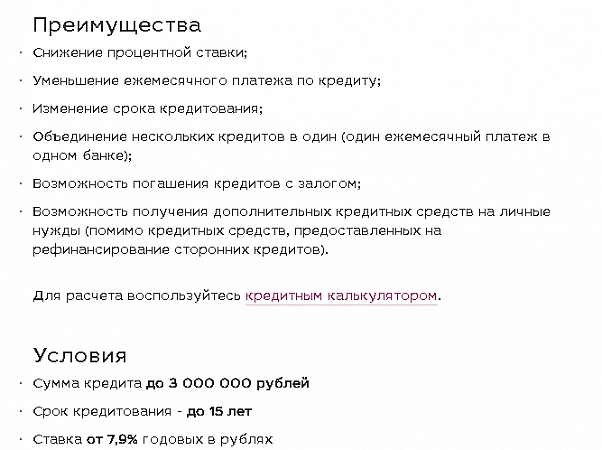

Top 3. Rosbank

Under the condition of life insurance, the bank offers an attractive rate of 5.9%, which will really help to reduce payment costs.

- Founded: 1993

- Website: rosbank.ru

- Phone: 8 (800) 200-54-34

- Amount: from 50,000 to 3,000,000 rubles.

- Interest rate: from 5.9 to 16.9%

- Maximum term: 7 years

The bank is ready to lend from 50,000 to 3 million rubles, which is enough to cover most loans. Rosbank makes it possible to obtain refinancing at a low rate of 5.9 to 16.9%. Salary customers can repay the loan for 7 years, not 5, as usual.In fact, the bank has fixed rates with a difference of 6 points. The lowest rate is available only when you take out insurance. If you cancel the policy, the rate automatically increases by 6 points. If you terminate the contract with the insurance company, you will have to pay extra interest even if the contract has already been concluded and some time has passed. You can also receive funds for personal needs, if necessary, but Rosbank is reluctant to issue them. It is not specified exactly how many loans can be refinanced at a time.

- Low interest rate subject to life insurance

- Payroll clients receive credit for up to 7 years

- It is possible to receive a larger amount than debt on loans

- You can apply for a small amount from 50,000 rubles

- High interest rate without insurance

- A set of documents is required to receive refinancing

See also:

Top 2. Moscow credit bank

No other bank can boast such a long loan term. If the borrower wishes, it is issued for 15 years.

- Founded: 1992

- Website: mkb.ru

- Phone: 8 (800) 775-51-52

- Amount: from 50,000 to 3,000,000 rubles.

- Interest rate: from 6.5 to 16.5%

- Maximum term: 15 years

Unlike other banks, Moscow Credit Bank in some cases approves the refinancing of loans for a period of 15 years. This would be very convenient for paying large debts that are difficult to repay in less time, but the maximum amount is only 3,000,000 rubles. However, the rate is really pleasing. It is enough to have a good credit history in the ICB or any other bank for it to be 7.9%.And for payroll clients, the conditions are even better - they receive a loan at 6.9%. The same conditions apply to pensioners, but the payment period is reduced to five years. When obtaining loans, you can do without certificates, with one passport, but in this case, the likelihood of approval will be less.

- The maximum loan repayment period is 15 years

- It is possible to repay loans with collateral

- Possibility of obtaining additional credit funds

- For payroll clients and pensioners, a reduced rate of 6.5%

- Quickly consider applications, decision from five minutes

- The maximum loan amount is 3,000,000 rubles

See also:

Top 1. Promsvyazbank

If necessary, the bank can provide the client with a "credit holiday". Within two months it will be possible not to make payments on the debt.

- Founded: 1995

- Site: psbank.ru

- Phone: 8 (800) 333-03-03

- Amount: from 50,000 to 5,000,000 rubles.

- Interest rate: from 5.5%

- Maximum term: 7 years

Convenient service and comfortable conditions are available for those who want to transfer loans to Promsvyazbank. You can repay the loan taken within 1-7 years. The minimum will be to receive 50 thousand rubles. The maximum refinancing amount is 5 million. No collateral is required at all, even for large loan amounts. The bank specifies that it is ready to refinance up to five different loans, including automobile and mortgage loans. I am glad that the institution provides an additional service "Credit holidays". Within its framework, the client can defer payments for two months. It is convenient if there are temporary difficulties. It is also possible to refinance extended or restructured loans.It is only necessary that there are no current debts on them, and over the past 6 months there have been no problems with repaying the loan.

- Service "Credit holidays", you can postpone payments for 2 months

- Reduced rate when applying for a financial protection loan

- Can refinance up to five loans and credit cards

- Getting additional funds for any purpose

- Possible refinancing of extended loans

- The maximum rate is not specified, it is determined by the bank individually