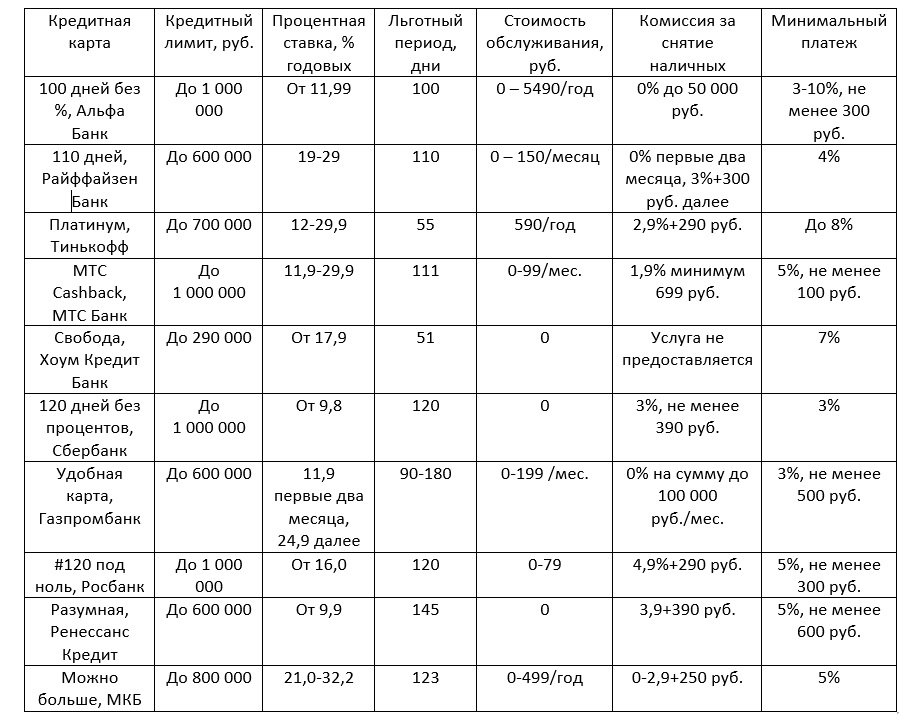

Place |

Name |

Characteristic in the rating |

| 1 | Alfabank - "100 days without%" | The best conditions for cash withdrawal, a card without pitfalls |

| 2 | Sberbank - Sbercard | New grace period of 120 days every month |

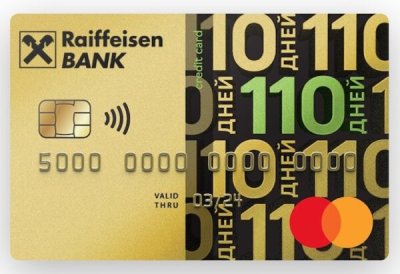

| 3 | Raiffeisen Bank - "110 days" | Large credit limit, fast processing |

| 4 | Gazprombank - "Convenient card" | The length of the grace period depends on card spending |

| 5 | Tinkoff - Platinum | Best mobile app, most popular |

| 6 | MTS Bank - "MTS Cashback" | Universal credit card with a good grace period |

| 7 | Home Credit Bank - "Freedom" | Large card limit, free annual service |

| 8 | Renaissance Credit - "Reasonable" | 145 days grace period for everything |

| 9 | Rosbank - "# 120 to zero" | Optimal grace period |

| 10 | Moscow Credit Bank - "More is possible" | Large grace period + up to 5% cashback |

Credit cards have firmly entered the lives of many people. With a sufficient level of financial literacy, this banking product can be very profitable.One of the advantages is that credit funds are available at any time and in any place. Well, the main plus is the ability to use them within the grace period, without paying interest to the bank.

You should never choose a credit card thoughtlessly, believing in advertising promises and not the most objective reviews, as well as blindly trusting bank employees. Before applying for a credit card, it is important to fully understand the terms of its service, the principles of the grace period and the level of responsibility in case of failure to comply with the requirements specified in the agreement with the bank. There are a number of key points to which you should pay special attention.

Terms of Service grace period - it can only apply to online purchases, card payments or absolutely all transactions.

Interest rate – how much you have to overpay for using credit funds outside the grace period depends on its size.

Maximum credit limit - this is the amount of funds that you can spend from your card. It all depends on the bank and the client's data, for each it is set individually.

Maintenance cost - for some cards you will not have to pay anything extra, others will be free only if certain conditions are met, others are always paid.

The rating includes the best credit cards with a comfortable grace period and generally attractive conditions. When selecting, we paid attention to the conditions of the grace period, the convenience of a mobile bank, additional bonuses, and feedback from holders.

Top 10 Grace Period Credit Cards

10 Moscow Credit Bank - "More is possible"

Grace period: 123 days

Rating (2022): 4.3

With the “More is Possible” credit card from the Moscow Credit Bank, you can really afford, if not everything, then a lot. The limit on it reaches 800,000 rubles. Up to 50% of this amount can be withdrawn in cash without paying any commission, which can be called one of the best conditions. But it should be borne in mind that the grace period does not apply to such operations. For the removal of more than 50% of the limit, the commission will be 2.9% + 250 rubles. But to pay for purchases and services, grace is a comfortable 123 days. The interest rate is standard - from 21% per annum.

Maintenance of the card will not require additional expenses next year if you spend at least 120,000 rubles on it in the current year. A credit card allows you to become a member of the MKB-Bonus program, which provides for the possibility of receiving a cashback. The standard is only 1%, but for some categories it is already 5%. A complete list of conditions for cashback can be found on the program website.

9 Rosbank - "# 120 to zero"

Grace period: 120 days

Rating (2022): 4.4

"#120 Zero" from Rosbank is ready to offer a credit limit of up to 1,000,000 rubles, in the amount of 100,000 rubles it is provided only with a passport. A card is issued for free if you spend on it from 15,000 rubles. per month, you don't have to pay for maintenance. If this condition is not met, the fee will be 79 rubles per month. The value of the grace period is embedded in the very name of the card, it is 120 days, which is quite good.

If you withdraw cash from this credit card, the commission is 4.9% + 290 rubles.If you wish, you can place your own funds on the card, but this does not give any benefit, because there is neither cashback nor interest on the balance. In reviews about the card and the bank, they often write that new customers are often denied a credit card or set very tiny limits. For those who receive a salary to an account with Rosbank or have a deposit here, the chances of quick approval and a significant limit are much greater.

8 Renaissance Credit - "Reasonable"

Grace period: 145 days

Rating (2022): 4.5

Credit card "Reasonable" from Renaissance Credit Bank is the best combination of a long grace period of 145 days and a favorable interest rate. This credit card will especially appeal to those who often visit the Pyaterochka supermarket and order a lot of goods on the pages of the Wildberries marketplace, because when buying goods in these stores, the rate is only 9.9% per annum. Spending in other places is subject to a rate of 24.9%, and for cash withdrawals, not the most attractive 49.9% per annum. The minimum monthly payment is 5%, at least 600 rubles.

According to the "Reasonable" card, the grace period applies not only to paying for purchases, but also to cash withdrawals, as well as transfers, which best distinguishes it from many analogues. The maximum amount of the credit limit is up to 600,000 rubles, income confirmation is not required, but there is a minimum income requirement.

7 Home Credit Bank - "Freedom"

Grace period: 51 days for everyone, a year if conditions are met

Rating (2022): 4.5

Home Credit Bank issued the Freedom credit card at the very end of 2018, offering favorable terms of use. The grace period is 51 days, you can purchase goods in any store. When buying at partner points, the period increases to 12 months. The card is issued and maintained free of charge. The interest rate for installment purchases from partners and spending in regular stores is 0% per annum. The latter can be made only within a separate limit, they are subject to a grace period of up to 51 days. When the installment or grace ends, interest will start to drip in the amount of 17.9%.

The reviews note convenient ways to replenish. You can make a monthly payment online on the official website from any debit card. Accept transfers from third-party terminals. However, the bank prohibited the withdrawal of cash. For delaying the monthly minimum payment, a fine of 590 rubles is imposed. Informing is included in the price for only 60 days, then it will cost 99 rubles per month. They offer account statements and changing the pin code for free.

6 MTS Bank - "MTS Cashback"

Grace period: up to 111 days

Rating (2022): 4.6

"MTS Cashback" is a universal credit card with a profitable cashback and a long grace period of up to 111 days. The credit limit can reach 1,000,000 rubles. The annual rate is 11.9-29.9% per annum. The service is free for the first 2 months, and then only those who will spend at least 8,000 rubles a month will not be able to pay for it. If this condition is not met, then the monthly maintenance fee will be 99 rubles.The minimum monthly payment required for the grace period is 5%, but not less than 100 rubles.

For the withdrawal of credit cash, a commission of 1.9% + 690 rubles is provided, you can withdraw your own funds without commission. One of the advantages of the card is the increased cashback. Its basic size is a modest 1%, but for certain categories it is already 5%, and for partners of the MTS Cashback service, the return can be up to 25%.

5 Tinkoff - Platinum

Grace period: up to 55 days for purchases, up to 120 days for credits

Rating (2022): 4.7

The Platinum credit card is one of the bank's most popular products. It offers a grace period of up to 55 days for any purchases, a cashback refund in the form of Bravo points from 1 to 30% of the purchase amount, as well as free cash deposits through bank partners. The interest rate varies from 12 to 29.9% per annum for purchases and from 30 to 49.9% for cash withdrawals and transfers. You can get a decision on issuing a card instantly, after which an employee will deliver it to your home within a few days. All operations are carried out in a simple and convenient application on a smartphone.

Cash withdrawal is made at any ATM with a commission of 2.9% + 290 rubles. The grace period does not apply to this operation. Annual maintenance costs 590 rubles, but if you do not use the card, then you will not have to pay anything. The maximum credit limit is 700,000 rubles. Advantages: low initial interest rate, cashback on all purchases, convenient round-the-clock support, easy financial management through the application. Disadvantage: high fees for cash withdrawals.

4 Gazprombank - "Convenient card"

Grace period: 90-180 days

Rating (2022): 4.7

A "convenient card" from Gazprombank can be really convenient, but only if you understand all the nuances and features. So, the credit limit on it can reach 600,000 rubles, the interest rate in the first two months of use will be 11.9%, but then it will rise to a rather high 24.9% (39.9% for cash withdrawals). The card is issued free of charge, you can not pay for the service subject to monthly expenses from 5,000 rubles.

The grace period for the "Convenient card" of Gazprombank is 90 or 180 days. How exactly it will depend on the costs of the owner of the plastic. If more than 60,000 rubles are spent within two months, then the grace period will be 180 days, and if less than this amount, then 90 days. You can apply for a card on the bank's website. There is also a list of cities to which it is delivered free of charge.

3 Raiffeisen Bank - "110 days"

Grace period: up to 110 days, for purchases

Rating (2022): 4.8

Credit card "110 days" allows you to profitably pay for purchases both in regular stores and online. Within 110 days, no interest on the funds spent will be accrued. If your expenses per month exceed 8,000 rubles, then the service will become free. You can receive and issue a card on the day of application. For transfers, quasi-cash transactions and cash withdrawals from ATMs of Raiffeisenbank, the commission will be 3% + 300 rubles. But it is not charged for the month of issuing the card and the next one. For receiving funds at third-party ATMs, you will have to pay 3.9% + 390 rubles.

The lowest annual rate for using a loan is 19%, the maximum - 29% (for cash withdrawals, transfers and other equivalent operations - 49%). The credit limit is set in the range from 15 to 600 thousand rubles. at the discretion of the bank. Main advantages: free service in case of compliance with the conditions, long interest-free period, quickly processed. Disadvantages: unprofitable online transfers and cash withdrawals, high annual rate, commission for replenishing the card.

2 Sberbank - Sbercard

Grace period: 120 days

Rating (2022): 4.9

Credit "Sberkarta" attracts attention with a number of very favorable and in many ways even unique conditions. The maximum allowable limit is up to 1 million, and for its approval, existing customers will not have to provide the bank with any certificates. The interest rate for purchases in the Health category, as well as on the pages of the SberMegaMarket marketplace, will be only 9.8%. In other cases, its size is 21.7%, which is a lot, but the rate is fixed and is always valid for everyone. It is not very profitable to withdraw cash - the commission is 3%, but not less than 390 rubles.

The interest-free period of 120 days at Sberbank is calculated differently from most other credit institutions. Here, a new grace begins on the 1st of each month, and it does not matter whether the debt is repaid or not. The grace period does not apply to cash withdrawals and equivalent operations. The minimum payment is fixed - 3%. You don't have to pay for release and maintenance. This plastic has many advantages. Announced relatively recently, he has already managed to collect a lot of positive reviews.

1 Alfabank - "100 days without%"

Grace period: up to 100 days for purchases

Rating (2022): 4.9

There are ATMs and branches of Alfabank in almost any city in Russia. The line of banking products includes favorable mortgage, car loans, assistance to medium and large businesses, and deposits. Despite the appearance of many similar credit cards, plastic from Alfa-Bank continues to be popular, including due to the high level of trust in the bank. The card allows the holder to use the funds for 100 days of an interest-free period. An important feature is that within a month you can withdraw up to 50,000 rubles in cash. absolutely free. No commission is charged for replenishing the card.

There are three statuses to choose from: Classic, Gold, Platinum. They differ in the maximum credit limit (from 500,000 to 1,000,000 rubles) and the cost of maintenance per year (from 590 to 5,490 rubles). In addition, the commission for cash withdrawals in excess of 50,000 rubles per month also differs (from 5.9%, but not less than 500 rubles, to 3.9%, but not less than 300 rubles). The decision on extradition is made in 2 minutes, the application is submitted online. The minimum interest rate starts from 11.99% per annum. Pros: 100 days grace period, low interest rate, best cash withdrawal conditions, large credit limit, great reviews. Cons: Expensive maintenance of a platinum card.

The main conditions of the credit cards presented in the rating