Place |

Name |

Characteristic in the rating |

| 1 | Alfa-Bank - "100 days without interest" | Best conditions for cash withdrawal |

| 2 | Russian Standard Bank - "Platinum" | Cashback + installment plan + possibility not to pay for service |

| 3 | Tinkoff - ALL Airlines | Best for travelers |

| 4 | Sberbank - Sbercard | Unique calculation of the interest-free period |

| 5 | Sovcombank - "Halva" | Low interest rate. The most popular installment card |

| 6 | UBRR - "Cash" | Grace period 1094 days |

| 7 | Promsvyazbank - "Double cashback" | Cashback for loan repayment |

| 8 | Home Credit Bank - "120 days without%" | Favorable cashback up to 30% |

| 9 | MTS Bank - "MTS Cashback" | 5% refund in supermarkets |

| 10 | Credit Europe Bank - "Urban Card" | Cashback for moving around the city and region |

Classic loans are gradually fading into the background, they are being actively replaced by cards. These are modern bank offers that involve the use of funds without interest for a certain period.Such cards are designed to pay for purchases and very rarely - to withdraw cash. Often, clients who need to apply for a credit card have only a passport with them or cannot document their income. Especially for such cases, some banks allow registration without additional information.

What are the criteria for choosing the best credit card?

Interest free period. It can be standard - about 50 days, and can reach several months.

Interest rate. In cases where you do not have time to repay the debt during the grace period, interest begins to accrue on it. The lower the rate, the better the conditions.

Cost of use. It consists of a service fee, informing in SMS messages, etc.

Purchase bonuses. Many banks provide an opportunity to save on costs with the help of a cashback service. This means that a certain percentage of each payment is returned to the card in the form of bonuses, with which you can either pay for goods in the future or get a good discount.

We found out which credit cards without income verification are the best. When choosing, they relied on the reviews of holders, the conditions for issuing a card, the transparency of tariffs and their profitability.

Top 10 Best Credit Cards Without Income Verification

10 Credit Europe Bank - "Urban Card"

Annual rate: 29%

Rating (2022): 4.0

Officially, this is not a credit card, but an overdraft product, the funds for which are provided at a fixed rate of 29%. The rather high annual rate is mitigated by the fact that it is fixed.When applying, you will always know what percentage you have to pay. To get a card, you only need a passport. The credit limit indicated on the bank's website is from 9,900 rubles.

A credit card is ideal for those who move around the city a lot. The maximum cashback is 10% for city transport, 5% for car and taxi services, 3% for car and motorcycle rentals. For all other purchases, only 1% return is charged. The card itself has no issuance and maintenance fees. Unfortunately, you can withdraw from the card no more than 10% of the credit limit. In addition, for this you will have to pay a commission of 4.9% (from 399 rubles) through a KEB ATM or 5.5% (from 499 rubles) when receiving at ATMs of other banks. But abroad there is no commission for withdrawal.

9 MTS Bank - "MTS Cashback"

Annual rate: from 11.9%

Rating (2022): 4.1

A good credit card without proof of income with a nice cashback. The maximum credit limit can reach 1 million rubles, and all this without proof of income, only on a passport. The card provides an increased cashback of 5% for purchases in several categories at once, including supermarkets, cafes and restaurants, and clothing stores. All other purchases are charged 1%. The maximum amount of cashback is also pleasing - 10,000 rubles per month. Alas, cashback can only be spent on payment for communication services or purchases in MTS stores, it will not work to convert it into rubles.

There is also a grace period of 111 days, but monthly you will need to pay at least 5% of the debt so as not to fall out of it. You can get a credit card at any MTS salon or MTS-Bank branch.The card allows you to withdraw cash with a commission of 1.9%, but not less than 699 rubles, and your own - without commission at all ATMs on the planet.

8 Home Credit Bank - "120 days without%"

Annual rate: from 10.9%

Rating (2022): 4.2

Only a passport and a work experience of 3 months are required to receive a "120 days without%" card from Home Credit Bank. No salary slips or proof of income. A card with a credit limit of up to 700,000 rubles has no service fee and allows you to receive up to 30% cashback from bank partners under the Polza loyalty program. The interest rate starts from 10.9%, but can reach up to 32%. It is set by the bank individually for each client, it can be found out only after receiving a decision on the approval of the issuance of a credit card.

For cash withdrawals on the card, not only a commission of 5% is provided, but also the interest for such use of credit funds is increased - 49.9%. The minimum card payment is 5% of the debt amount, but cannot be less than 500 rubles. Conditions are not the most favorable, but generally adequate.

7 Promsvyazbank - "Double cashback"

Annual rate: 23%

Rating (2022): 4.3

An interesting credit card with a developed cashback program that can suit any person, and the ability to get it only with a passport. The limit on it can be up to 1 million rubles, but without confirmation of income and without being a payroll client of the bank, it is unlikely that you will have to rely on significant amounts. The interest rate is fixed at 23% per annum, the standard grace period is 55 days.The card is issued and maintained free of charge, including an additional one, but a fee of 69 rubles is charged for SMS informing. Cash withdrawal is subject to a commission of 4.9% + 390 rubles, which is quite a lot.

There are three cashback packages with different categories: "Leisure", "Auto", "Family". This allows any client to choose the most suitable option for him. Each package has three categories for 10%, 7% and 5% return. Any purchase outside of these categories is eligible for a 1% refund. Moreover, Promsvyazbank returns 1% of the amount paid to pay off the debt. Alas, cashback is credited only for spending credit funds.

6 UBRR - "Cash"

Annual rate: from 0.01%

Rating (2022): 4.4

To obtain a credit card "Cash" from UBRD, proof of income is not required, but the bank imposes a requirement for a length of service, which must be at least 3 months. The credit limit on the card is small, only 150,000 rubles, but for most this will be enough. The grace period is not just long, but one of the most impressive, and is 1094 days. The interest rate after its completion is also miserable, only 0.01%, but you still have to pay to use the loan.

The Cash card has a very substantial maintenance fee - it is 1 ruble per day for every 1,000 rubles of debt, but cannot exceed 60 rubles. Given this approach, the interest-free grace period seems to be just a publicity stunt, since it does not provide benefits. The conditions for withdrawing cash on the card are not very attractive, the commission is 5.99%. In general, it can be convenient for small and short loans.

5 Sovcombank - "Halva"

Annual rate: from 0%

Rating (2022): 4.5

Sovcombank offers one of the most profitable and popular installment cards. With each purchase, it provides a unique opportunity to return the funds spent without interest within 10 months. For purchases in individual stores, a longer installment plan may be granted. The bank's partners include the largest networks selling children's goods, household appliances, travel agencies, optics stores, jewelry, etc. To obtain a card, you only need a passport, proof of income is not among the prerequisites. But the bank will issue a credit card only if the client has a landline or mobile phone, as well as his employment at the last workplace for at least 4 months.

Moreover, you can withdraw cash from a credit card - and also in installments! The card provides a cashback, the amount of which depends on whether own funds are spent or borrowed, as well as on the place of purchase and whether the store is a partner. If you store your own funds on plastic, interest will be charged on the balance. When making at least one purchase on the card, it will be 4%, but under a number of conditions, the rate can reach 10%. Credit limit - up to 350,000 rubles at 0% per annum for 36 months, then - 10% per annum. The advantages include favorable terms of use, the possibility of delivery by courier, the absence of service fees, the best limits for the grace period. Plus, the money can be withdrawn in installments. Disadvantages: cashback is credited only when you spend your own funds - credit does not count.

4 Sberbank - Sbercard

Annual rate: from 9.8%

Rating (2022): 4.6

Credit "Sberkarta" from Sberbank is in many ways a unique product that has no analogues in the financial market. It is issued and maintained free of charge, has no hidden fees and paid services. The interest rate starts from an incredibly low 9.8% per annum, however, it only applies to purchases in SberMegaMarket and in the Health category. The first 15 days after registration, you can withdraw cash without a commission, then it will be 3%, but not less than 390 rubles. The main advantage of the card is a long grace period of 120 days, which is renewed monthly, and not after the full repayment of the previous debt.

Existing Sberbank customers can apply for a card in the app and receive a decision and start using the product in a couple of minutes. New customers will only need a passport to apply for a credit Sbercard. The maximum credit limit on the card is 1,000,000 rubles, but only a few can really count on such an amount. There are still relatively few reviews about this card, but their authors have very modest credit limits for plastic.

3 Tinkoff - ALL Airlines

Annual rate: from 15%

Rating (2022): 4.7

Proof of income is also not required to apply for the next card. You only need to fill out an online form with passport data, and then, if the answer is positive, wait for delivery directly to your home. ALL Airlines was created for those who cannot imagine their life without traveling. Holders receive free life insurance for a large amount and very favorable conditions for cashback.From each payment, 2% of spending in the form of miles is charged, and for operations related to travel (buying tickets, booking hotels and cars) up to 10%. And there is also a cashback from partners - it can reach 30% of the purchase amount.

The maximum credit limit on the card is up to 700,000 rubles. For withdrawing funds from an ATM or online transfer, you must pay a fee of 390 rubles. You can return the spent funds without overpayment within 55 days. The minimum annual rate for card payments is 15%, and for cash withdrawals and quasi-cash transactions - from 29.9%. Maintenance of a credit card will cost 1890 rubles per year, an additional card for relatives and friends is free. Main advantages: operates all over the world, multifunctional Internet bank, the best conditions for travelers. Disadvantages: a large minimum payment - within 8% of the amount owed, a large minimum rate for cash withdrawals.

2 Russian Standard Bank - "Platinum"

Annual rate: from 9.5%

Rating (2022): 4.8

The Platinum credit card is distinguished by an advantageous combination of conditions and promotions from the bank. The interest rate starts from 9.5% per annum, but is set individually for each client and, in fact, can be several times higher. You can withdraw cash in any country, city and ATM without commission, but only in the first 30 days after receiving a credit card: then you will have to pay 3.9% + 390 rubles. The maximum credit limit is 300,000 rubles. It is set for each client separately at the discretion of the bank. The card provides cashback - 1% for everything, 5% for three selected categories and up to 25% for purchases from partners.The term of interest-free repayment reaches 55 days.

To apply for a credit card, you will need a passport and some additional document (license, passport, etc.). You can apply for graduation online. The service costs 79 rubles per month, but you won’t have to pay for it if you make purchases with a card from 15,000 rubles. per month. The bank often runs promotions that allow holders to make purchases at deep discounts from partners. It is also possible to buy in installments for up to 24 months. Main advantages: cashback, inexpensive service, quick application processing.

1 Alfa-Bank - "100 days without interest"

Annual rate: from 11.99%

Rating (2022): 4.9

Credit card "100 days without interest" from Alfa-Bank at one time became one of the first to offer an extended grace period. Despite the appearance of a large number of analogues, it is still one of the most popular and profitable. The maximum credit limit on the card is 1,000,000 rubles, but only with a passport you can count on a maximum of 150,000, which is also very good. By attaching any second identity document to the application for a card, you can count on an increase in the credit limit up to 200 thousand. The minimum monthly payment is from 3 to 10% of the amount owed, but cannot be less than 300 rubles. In case of non-payment, the penalty will be 20% per annum. Maintenance of the card in the first year will be free, then it will be from 590 rubles per year.

One of the advantages of the card is the ability to withdraw cash up to 50,000 rubles without any commission. You can also withdraw a large amount, but with a payment of 5.9%.There are a lot of reviews about this card, which allows us to judge its demand among bank customers. There are also negative statements about a credit card, however, if you get acquainted with their essence, the subjective nature of the claims and the low level of financial literacy of the author become clear. When used correctly, "100 days without interest" is no worse, and in many ways even better than other cards.

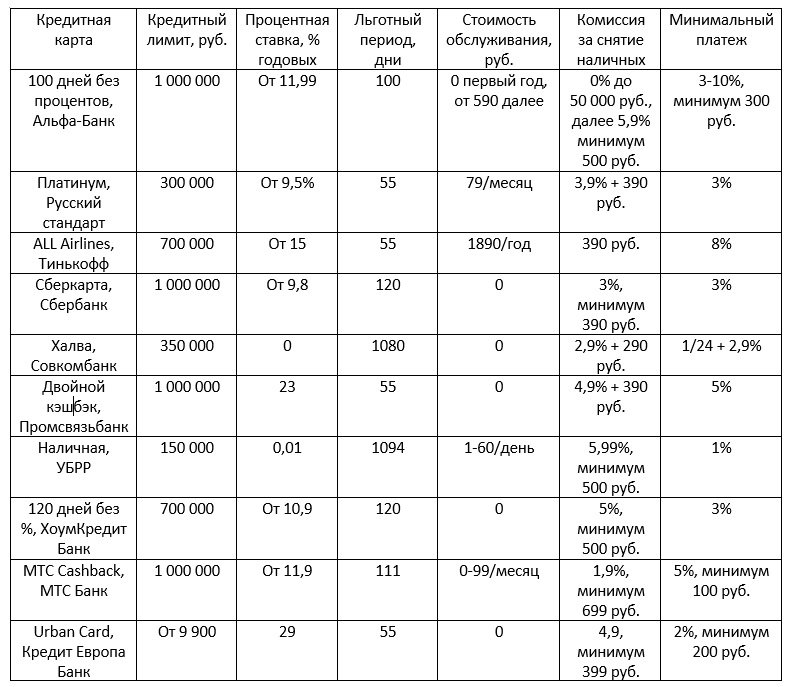

The main parameters of credit cards participating in the rating