Place |

Name |

Characteristic in the rating |

| 1 | Alfabank – Yandex.Plus | Collaboration with Yandex services |

| 2 | Tinkoff Bank – Tinkoff Black | Individual conditions for cashback for each |

| 3 | Gazprombank - "Smart Card" | The most profitable cashback in "live" rubles |

| 4 | UBRD – My Life | The highest cashback on utility bills |

| 5 | UniCredit Bank - Cash&Back | There are no restrictions on the amount of remuneration received |

| 6 | OTP Bank - "Maximum +" | Double benefit - 10% cashback + 10% on the account balance |

| 7 | Otkritie Bank – Opencard | Popular card with clear conditions |

| 8 | Promsvyazbank - "Your cashback" | The best number of categories to choose from |

| 9 | Fora-Bank - "All inclusive" | Debit card with credit limit option |

| 10 | VTB - Multicard | Best cashback from partners + additional bonus options |

Read also:

Cashback is the return of part of the expenses in the form of bonuses or regular money.The first option is now more common and involves crediting funds to a special bonus account, from which they can then be debited to compensate for previously made purchases, pay card expenses (SMS informing or monthly maintenance), and receive discounts. Different banks offer their own unique cashback conditions. Somewhere it applies to specific categories, and somewhere to all purchases.

It can take from several hours to several days to issue a debit card with cashback. In order not to get confused among the huge number of offers, when choosing a card, you should pay attention to a number of key factors.

Conditions for cashback. Pay attention to its size, the possibility of accumulation when shopping in different places, etc. Some banks allow customers to choose their favorite places from which funds will be returned. Others set categories themselves, for example, gas stations, travel, cafes and restaurants, etc. The higher the cashback percentage, the more profitable it will be to pay for purchases with a card. Another important point is the conditions for using the received bonuses. Some banks do not limit the places where you can spend them, others allow you to do this only with partners.

Interest on balance. In order not only to save money, but also to increase your income, you should choose a card with a percentage on the account balance. The interest rate may vary depending on the conditions.

Maintenance cost. Be sure to specify how much the card maintenance fee is. For some banks, this amount reaches 5,000 rubles a year, which may not be particularly beneficial for holders. Also, do not forget to find out if it is possible not to pay for the service at all.Some institutions, under certain conditions, relieve customers of the obligation to pay for the work of the card, which is very nice.

Commissions. When applying for a card, it is very important to know the conditions for withdrawing cash. Some cards make it possible to do this at any ATM absolutely free of charge, others withhold a certain commission. Also pay attention to the interest on online transfers.

We have selected the best deals on debit cards with cashback. When selecting, several factors were taken into account, namely the availability of a convenient mobile application, terms of use, feedback from holders. as well as the return percentage.

Top 10 Cashback Debit Cards

10 VTB - Multicard

Cashback: 1.5%, up to 30% with partners

Rating (2022): 4.4

VTB Bank is one of the largest in Russia. It is actively developing its activities, offering new innovative products, including profitable debit and credit cards. Many of them are issued by large organizations as salary. Debit Multicard offers a relatively small base cashback. With expenses on the card up to 30,000 rubles. it will be 1%, from 30,000 to 75,000 rubles. – 1.5%. But the conditions for cashback from partners are among the best and most attractive, because in some cases the return can be up to 30% of the costs. In addition to cashback, the card also provides other bonus options, for example, "Savings", which allows you to receive up to + 3% per annum on the current account, "Borrower" - minus 1% of the cash loan rate.

All options take effect when spending on the card reaches 10 thousand rubles. Card service is always free and without conditions, but for SMS informing you will have to pay 59 rubles / month.When connecting options with an extended level of remuneration, the fee will be 249 rubles per month.

9 Fora-Bank - "All inclusive"

Cashback: up to 7%

Rating (2022): 4.45

Cashback from bank partners on the All Inclusive card can reach 20%, but its basic values are not so impressive. Thus, for Visa Gold, Mastercard Gold and Mir cards, it is 1.1% for all purchases, 2% for gas stations and 5% for certain seasonal offers, the list of which changes regularly. For the Visa Platinum card, these figures are slightly higher. You can earn an income of 5.5% on the card balance, but only if you keep from 60,000 to 1,000,000 rubles on your account.

The best conditions are provided to students, pensioners and employees of municipal and state institutions - they do not need to pay at all for servicing Visa Gold, Mastercard Gold and Mir cards. The rest will be able to save on service fees only at expenses of 15,000 rubles. or account balance from 30,000 rubles. If the conditions are not met, the fee will be 99 rubles. Visa Platinum will cost even more, there are no discounts for students and pensioners, you can not pay only for purchases from 30,000 rubles. or balance from 60,000 rubles. If the condition is not met, then the fee will be 199 rubles per month. But for this premium card, the Priority Pass is included in the service package free of charge, giving privileges to travelers. Although the card is a debit card, but at the request of the client, a credit limit of up to 500,000 rubles can be set on it. at 19.5% per annum.

8 Promsvyazbank - "Your cashback"

Cashback: 1.5% on everything or 2-5% on three categories

Rating (2022): 4.5

Promsvyazbank has created a unique debit card, the benefits of which its owner can choose for himself. If we talk about cashback, then two options are available - a 1.5% return on all purchases or a multi-stage return system. If you wish, you can get up to 5% in three different sections (offering 2, 3 and 5% return) - a total of 20 categories. A maximum of 3,000 return points for the selected categories is credited per month. Interest on the balance of 5% can be selected as one of the categories of increased cashback. Another option for earning income is to choose the option of 4% on the balance, but without cashback.

You can transfer money to cards of other banks up to 100 thousand rubles per month without commissions. In third-party ATMs, it is allowed not to pay for withdrawals in the range from 3 to 30 thousand rubles. Card service is free, provided that you spend at least 5,000 rubles a month. If the condition is not met, then the fee will be 149 rubles / month.

7 Otkritie Bank – Opencard

Cashback: up to 2.5% on any product

Rating (2022): 4.55

Opencard cashback can reach 2.5%. 1% is always charged, +1% when paying for a purchase using a phone or smart device, +0.5% for all accounts with a balance of 500,000 rubles or more. Cashback from partners can reach 30%, but in reality, such offers are extremely rare. The maximum you can get with Opencard bonuses is up to 5,000 rubles. per month. Bonus rubles can compensate for any already completed purchase in the amount of 1,500 rubles.

The card is serviced free of charge without any conditions. You will have to pay 500 rubles for its issue, but these funds will be returned to the account in the form of bonuses after spending on the card from 10,000 rubles.There is no interest on the balance on the card, but when connecting the My Piggy Bank savings account, income can be up to 6.5%. Judging by the reviews, earlier this card was more profitable in terms of cashback, because it allowed you to return up to 11%.

6 OTP Bank - "Maximum +"

Cashback: up to 10%

Rating (2022): 4.6

The debit card is of interest to everyone who wants to receive an increased ruble cashback (10%) for purchases in the categories "Pharmacy", "Fast food" and "Public transport". Interest on the account balance is accrued when its balance is from 10,000 to 2,000,000 rubles. If you spend less than 5,000 rubles per month, then they will amount to 8% per annum. And with expenses on the card from 5,000 rubles. per month - 10% per annum. The card is serviced and issued without commissions, but 99 rubles / month is charged for SMS informing, it will be free only in the first 2 months.

The reviews contain both positive and negative about the bank. They write that there are problems with blocking and closing an account, automation does not always correctly calculate the percentage and monetary reward. Many thanks to individual employees. If I didn't have to contact consultants often, the rating of the product would be much higher.

5 UniCredit Bank - Cash&Back

Cashback: up to 10%

Rating (2022): 4.65

The Cash&Back debit card from Unicredit Bank provides a unique opportunity to receive cashback up to 10%, and its size during the month is not limited in any way.Three options are available to the client: "Smart cashback" - up to 5% for the category of maximum spending with expenses over 75,000 rubles, "Cashback for everything" - 1% with expenses up to 50,000 rubles, 1.5% - up to 100,000 rubles, 2% for expenses from 100 to 300 thousand rubles, "Auto" is the most profitable option, because it is here that you can get a 10% return, but with spending from 50,000 rubles. by taxi, car sharing, public transport, gas stations, parking lots and toll roads. You can receive cashback on this card both in rubles and with bonuses on the card of one of the bank's partners.

Plastic will be serviced free of charge subject to the balance on it from 100,000 rubles. or turns from 30,000 rubles. Otherwise, the usage fee will be quite high 249 rubles / month. No interest is accrued directly on the card balance, but if you use it in combination with the Click savings account, you can receive up to 5.5% per annum.

4 UBRD – My Life

Cashback: up to 5%

Rating (2022): 4.7

The My Life debit card from the Ural Bank for Reconstruction and Development has one very significant difference from many other similar products. It lies in the fact that a high cashback of 5% can be obtained from it where it is impossible for other banks, namely for paying utility bills. There are only a couple of restrictions - you need to spend at least 5,000 rubles on the card, and the monthly return cannot exceed 500 rubles. Additionally, you can get 5% cashback (no more than 1,000 rubles) for online purchases and 1% (no more than 5,000 rubles) for all other expenses. Taking into account the fact that the card is issued and serviced for 0 rubles, it turns out to be very profitable.

Cash withdrawal is free at our own and partner ATMs, but if you spend more than 5,000 rubles on a card every month, you can receive cash anywhere without paying a commission. SMS notifications are not paid only for the first two months, then their cost will be 99 rubles per month.

3 Gazprombank - "Smart Card"

Cashback: up to 10%

Rating (2022): 4.75

A "smart card" in the debit version from Gazprombank offers several advantages at once, including free service and up to 30% cashback on purchases from partners. In addition, the cardholder can choose from several loyalty programs. Among them, “Clear cashback” - 1.5% returned from all purchases, “Miles” - receiving 4 bonus miles for every 100 rubles of expenses, “Smart cashback” - up to 10% in the category of the largest expenses and 1% on everything . The maximum 10% refund can be obtained for expenses from 75,000 rubles. One of the biggest advantages is that cashback is returned in regular rubles, which eliminates any restrictions on its use.

The card is serviced without additional payments. You can withdraw cash from it without commission at Gazprombank ATMs and up to 100,000 rubles per month and no more than three times at any other. When opening a savings account in a mobile bank, you can receive income on the balance up to 9.5%. Reviews about this card can be found different, but there is no doubt that if you understand the conditions of its work, it will be beneficial.

2 Tinkoff Bank – Tinkoff Black

Cashback: up to 15% in three selected categories

Rating (2022): 4.8

Tinkoff Bank offers its customers favorable terms for loans, debit and credit cards, mortgages and other banking services. Registration of all bank products takes place online, and documents and plastic cards can be received by courier in most cities of Russia, which, judging by the reviews, is liked by many. The Tinkoff Black debit card allows its owners to choose categories for purchases in which 2-15% cashback will be credited. The specific amount of the increased cashback is determined individually for each client. At the same time, 1% bonuses are guaranteed to be returned from all other costs. In the future, they can compensate for already made purchases. I am pleased with the inflated cashback for purchasing something from partners: you can get up to 30% return.

Replenishment of the card account is free of charge by any means, as well as cash withdrawals. Tinkoff Black allows you to earn interest on your account balance. How exactly it will depend on a number of conditions. If you subscribe to Tinkoff and make purchases from 3,000 rubles per month, then for the balance up to 300,000 rubles. 7% per annum will be charged, under the same conditions, but without a subscription - 4%. The process of registration and issuance of the card takes only two days, as a result, the employee delivers it to you right at home. You can not pay for the service if you store at least 50,000 rubles on the card. or have a current loan at Tinkoff Bank. Otherwise, you will have to lay out 99 rubles a month.

1 Alfabank – Yandex.Plus

Cashback: up to 10%

Rating (2022): 4.9

An Alfa-Bank debit card opens up great deals for subscribers of Yandex services.It allows you to get the best 10% cashback for paying for Taxi, Food, Poster and other services. In addition, 1%; returns absolutely from all purchases, as well as 6% from travel.alfabank.ru expenses. You can also save on the cost of a Yandex Plus subscription, because if the turnover on the card exceeds 10,000 rubles during the month, its cost, which is 169 rubles, will be compensated. For account balance up to 300,000 rubles. 8% per annum is charged, but only the first month, then the income will be only 3%.

The maximum cashback amount is limited to 6,000 rubles. per month. Cash withdrawals are free of charge at ATMs of the bank and partners, but a nice bonus will be the ability to withdraw up to 50,000 rubles per month at any ATMs around the world. For the amount more you will have to pay 1.9% commission.

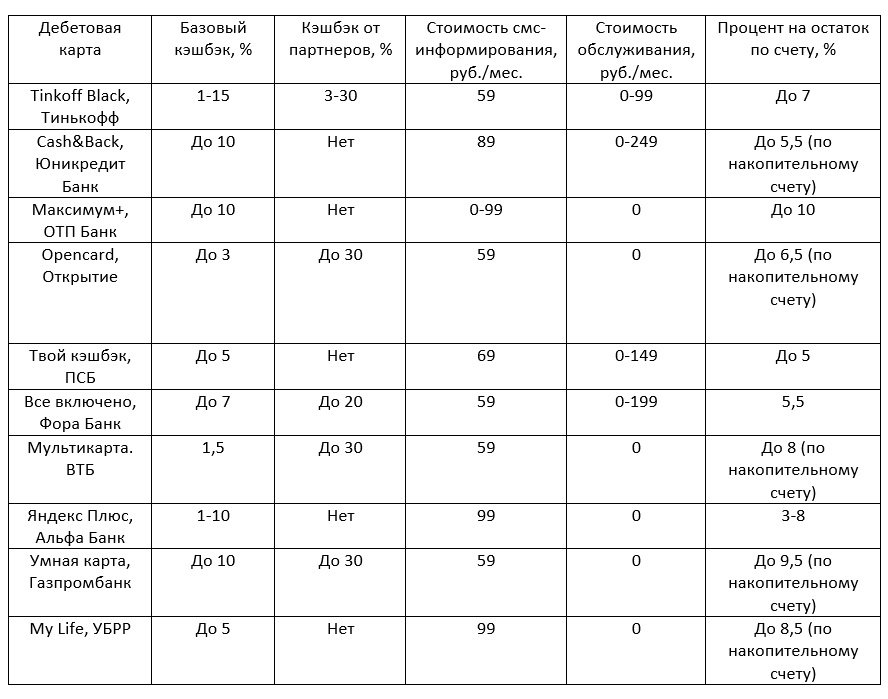

The main parameters of debit cards participating in the rating