|

|

|

|

|

| 1 | Reliable partner, Opening | 4.90 | The best offer for pensioners. The most favorable for accommodation for 6 months |

| 2 | The right choice, Moscow Industrial Bank | 4.80 | The best conditions for accommodation for 3 months |

| 3 | Renaissance Special, Renaissance Credit | 4.70 | The highest percentage |

| 4 | Optimal, Sovcombank | 4.60 | High interest + possibility of replenishment |

| 5 | Sberbank, Sberbank | 4.50 | One of the most popular contributions |

The increase in the key rate by the Central Bank of the Russian Federation became a trigger for an almost instantaneous increase in interest on deposits for individuals. Literally within a couple of days, banks in Moscow and other regions raised rates by 2.5-3 times from the previously existing ones. The increase in deposit yields occurred both in large credit institutions, such as Sberbank, VTB, Otkritie, and in small ones, including regional ones. Since the situation in the financial market can change rapidly, the highest percentage is now valid for short-term placement of funds for 1-3-6 months.

The current high interest rates on deposits should help the population, including pensioners, to survive the rise in inflation in the country with less losses.Also, this measure is beneficial for the banking sector, which will receive additional funds, because at 18-22% people will incur money on deposits more actively than at previously existing rates.

We have prepared a rating of deposits with the highest interest rates today. The TOP also included offers from those banks that were under sanctions, since we are sure that nothing threatens their work inside the country. The information presented in the material is current as of March 10, 2022.

Top 5. Sberbank, Sberbank

"Sbervklad" from Sberbank can be classified as one of the most popular. The rate on it is not the highest, but very worthy. During the first days of March, the bank was able to attract depositors' funds in the amount of more than 1 trillion rubles.

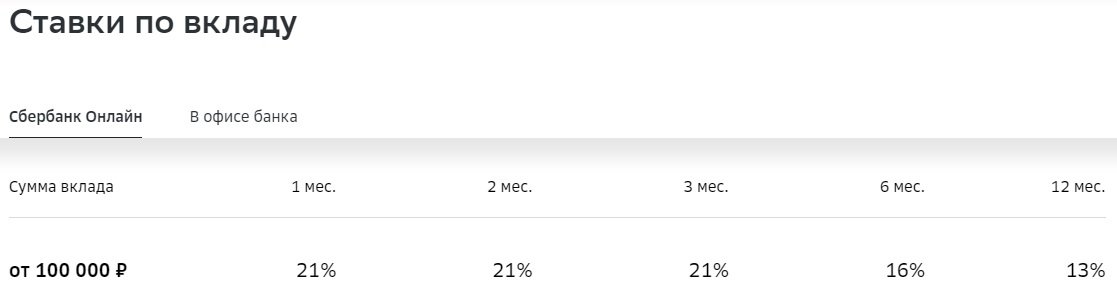

- Interest rate: up to 21%

- Amount: from 100,000 rubles.

- Term: 31, 62, 91, 181, 367 days

- Deposit/withdrawal: yes/no

- Interest payment: at the end of the term

- Extract from the bank's tariffs under the conditions for applying the interest rate as of 03/10/2022

Sberbank did not stand aside from the increase in interest on savings products and updated the tariff for Sberinvest. Now, individuals, including pensioners, can receive up to 21% per annum on it. This rate is valid when placing funds for a period of 1, 2 or 3 months. If you put money for 6 or 12 months, then the percentage will be 16 and 13, respectively. Such conditions for the size of the rate apply when opening a deposit online, in case of contacting bank employees, the rate will be 1% lower. The minimum amount of placement in Sberbank is from 100,000 rubles. Interest is calculated at the end of the term. Partial withdrawal of funds is not provided, but replenishment is possible.

- Rate up to 21% per annum

- It is possible to replenish the deposit

- Opening online or in the office

- Favorable conditions only for accommodation up to 3 months

- The minimum amount is 100,000 rubles.

Top 4. Optimal, Sovcombank

The "Optimal" deposit offers not only a high interest rate, but also the possibility of depositing additional funds into the account to receive even more income.

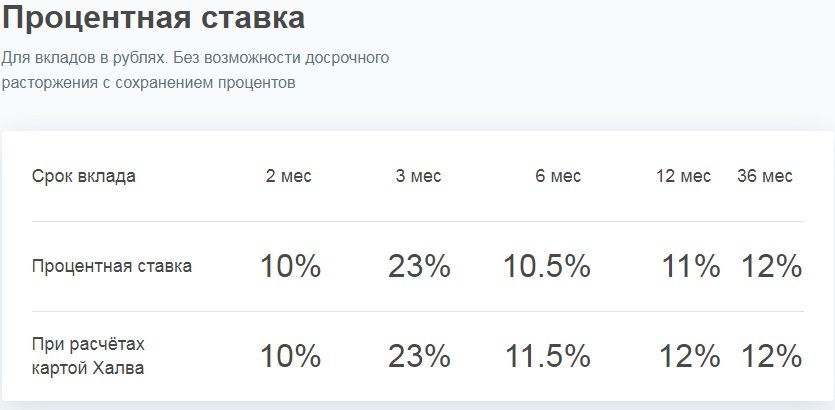

- Interest rate: up to 23%

- Amount: from 50,000 rubles.

- Term: 61, 91, 180, 367, 1095 days

- Deposit/withdrawal: yes/no

- Interest payment: at the end of the term

- Extract from the bank's tariffs under the conditions for applying the interest rate as of 03/10/2022

The "Optimal" deposit from Sovcombank promises individuals an income of up to 23% per annum, but it can be received only in one case, namely when placing funds for a period of 3 months. Despite this, we could not but include this offer in the list of the most profitable to date, because even for a short period of 23%, not every bank is ready to offer. You can place money in Sovcombank for other periods, but the rates will not be impressive at all. The minimum deposit amount "Optimal" starts from 50,000 rubles. Additional deposits are possible, but their volume is limited - you cannot deposit more in total than was on the deposit 10 days after it was opened. But withdrawals are not provided.

- 23% for 3 months

- Depositing additional funds

- The minimum deposit is from 50,000 rubles.

- Top-ups are limited

Top 3. Renaissance Special, Renaissance Credit

Renaissance Credit Bank offers a deposit with the highest and most favorable rate of 25% today, although such a percentage is valid only when placing funds for 1 month.

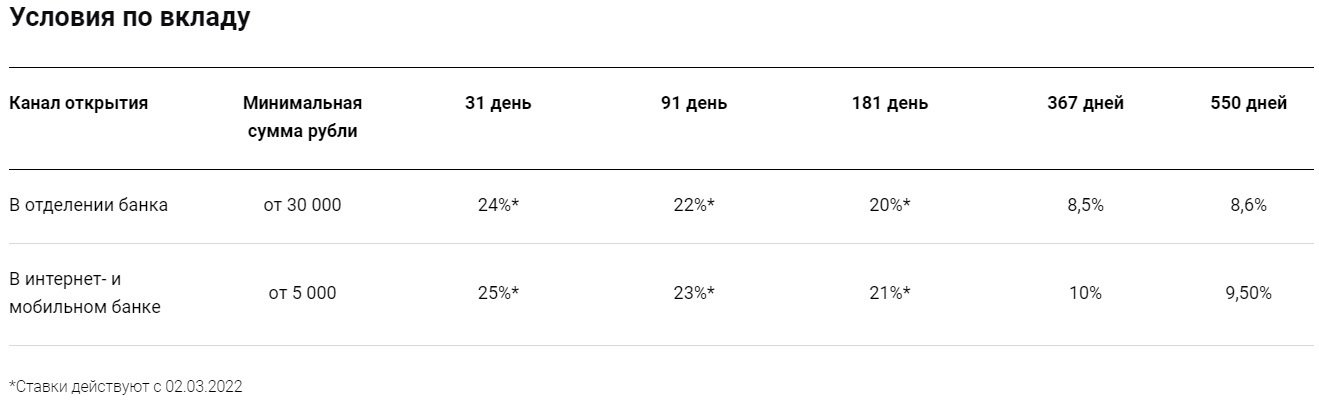

- Interest rate: up to 25%

- Amount: from 5,000 rubles.

- Term: 31, 91, 181, 367, 550 days

- Deposit/withdrawal: no/no

- Interest payment: at the end of the term

- Extract from the bank's tariffs under the conditions for applying the interest rate as of 03/10/2022

Renaissance Credit offered truly generous conditions in terms of interest on deposits, because here it reaches 25% per annum. However, not all so simple. The maximum 25% can only be received on a deposit for a period of 31 days and opened in the Internet or mobile banking. With a period of placement of funds for 3 months, the percentage will also be very profitable 23%, for 6 months 21%, but for a year it is only 10%. If you apply to open a deposit at a bank office, the rate will be 1% lower. The minimum deposit is only 5,000 rubles, operations for depositing additional funds or withdrawing part of them are not provided, interest is accrued at the end of the term. The Renaissance Special deposit is valid from March 2, 2022. Most likely, the conditions for it will change.

- The highest percentage

- Favorable rates when placed for 1, 3 and 6 months

- Low minimum amount

- Increased rate when opening in Internet and mobile banking

- 25% rate for 1 month only

Top 2. The right choice, Moscow Industrial Bank

By opening a deposit for 3 months in the Moscow Industrial Bank, you can get an income of 24% per annum, which is the best condition for placement for such a period.

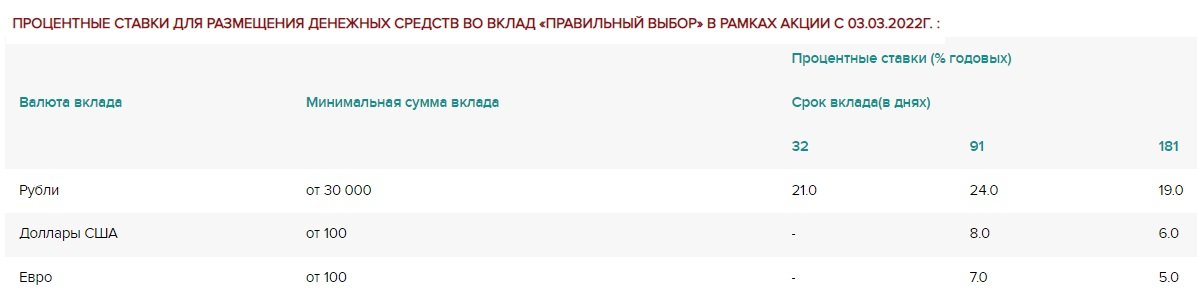

- Interest rate: up to 24%

- Amount: from 30,000 rubles.

- Term: 32, 91, 182 days

- Deposit/withdrawal: no/no

- Interest payment: at the end of the term

- Extract from the bank's tariffs under the conditions for applying the interest rate as of 03/10/2022

Among the banks of Moscow, which are also represented in other regions, one of the most advantageous offers for today is the “Right Choice” deposit. You can open it at the Moscow Industrial Bank, receiving 24% per annum, subject to the placement of an amount of 30,000 rubles for a period of 3 months. The deposit is also available for 1 or 6 months, but the rates will be lower. Both withdrawals and replenishments are not provided. You can make a deposit "The Right Choice" both for yourself and in favor of third individuals. It is also possible to place funds in dollars or euros, which is currently not offered by all banks. For accommodation for up to 3 months, this offer is currently the most profitable.

- 24% when placed for 3 months

- Small minimum deposit amount

- Discovery in favor of a third party

- Not only rubles, but also euros and dollars

- No withdrawals and deposits

See also:

Top 1. Reliable partner, Opening

The "Reliable Partner" deposit for pensioners and payroll clients will allow you to get a profitable 22% per annum.

Most banks in Moscow and the regions have a high rate on deposits only when it is issued for a period of 1-3 months, and a deposit for 6 months is available at Otkritie at 22% per annum.

- Interest rate: up to 22%

- Amount: from 50,000 rubles.

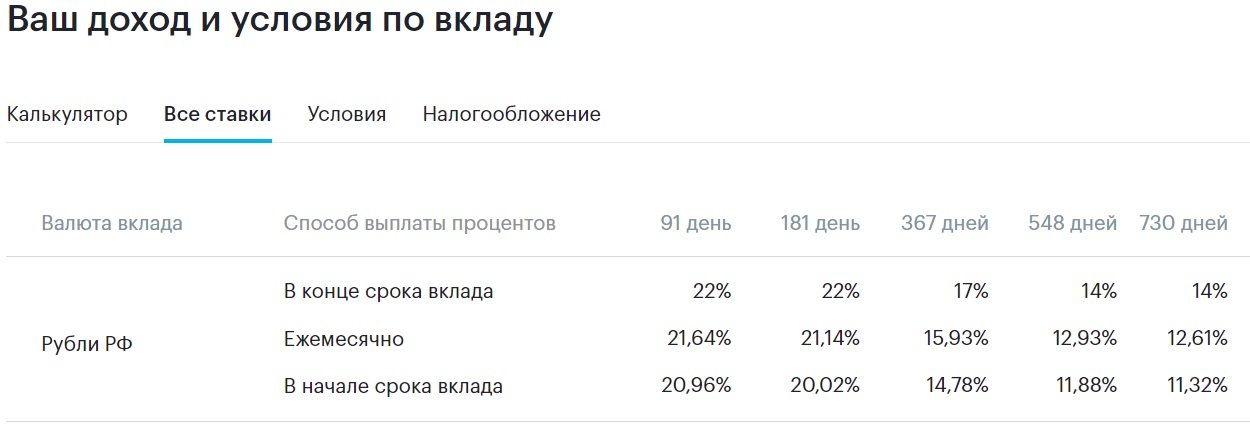

- Term: 91, 181, 367, 548, 730 days

- Deposit/withdrawal: no/no

- Interest payment: at the end of the term / monthly / at the beginning of the term

- Extract from the bank's tariffs under the conditions for applying the interest rate as of 03/10/2022

Otkritie Bank offers favorable conditions for investing funds for different people, but the most attractive ones are for payroll clients and pensioners. Especially for these categories of individuals, the bank has developed the "Reliable Partner" deposit, for which the percentage reaches 22% per annum. You can get the maximum rate when placing funds for 3 or 6 months, as well as if you choose to receive interest at the end of the term (options are also possible at the beginning of the term and monthly). The minimum deposit amount is 50,000 rubles, withdrawals and replenishments are not provided. You can also apply for a "Reliable Partner" for 1, 1.5 or 2 years, but the rate will be lower. To date, the offer of Otkritie Bank can be called one of the most profitable in Moscow and other regions for placing funds for 6 months.

- Favorable conditions for pensioners and salary clients

- 22% when placed for 3 or 6 months

- Three options for earning interest

- No withdrawals and deposits

See also:

Basic conditions for the most profitable deposits today