|

|

|

|

|

| 1 | Profit, Uralsib | 4.90 | The most profitable |

| 2 | Tinkoff Black, Tinkoff | 4.85 | The simplest terms. Favorable cashback up to 15% |

| 3 | Bought-Accumulated, Tavrichesky Bank | 4.84 | Up to 8% income |

| 4 | Maximum income, Loko-Bank | 4.75 | The best alternative to deposit |

| 5 | Green World, Post Bank | 4.70 | The most profitable for children's savings |

| 6 | Maximum+, OTP Bank | 4.65 | Best conditions for new clients |

| 7 | It's time, Ural Bank for Reconstruction and Development | 4.60 | Best map in active use |

| 8 | Benefit, Home Credit | 4.55 | 5% annual income + 5% cashback for 3 categories |

| 9 | Evolution, Ak Bars | 4.50 | Up to 5% annual income + accrual of "Universal Miles" |

| 10 | Alpha card with benefits, Alfa-Bank | 4.45 | Free debit card |

In order to attract new and retain existing customers, banks are ready to make them the most profitable, and sometimes truly unique offers. One of them is debit cards, on the balance of which interest is charged. Each credit institution has its own terms and conditions. If some have a very small percentage, then others are often comparable to the conditions offered for deposits.

Interest on the balance on a debit card is a pleasant and profitable option, but only if it is planned to store significant amounts on plastic.If there is usually little money on the account, it is used as a salary and the funds on it are often spent in full, then there is no need to talk about high attractiveness. Also, when choosing a card, it is important to carefully read all the conditions for receiving income. Often promotional offers look much better than reality. When compiling the rating of the best debit cards, we took into account not only the amount of interest that can be received on the balance of funds, but also other service conditions. The data presented in the material is current as of November 15, 2021.

Top 10. Alpha card with benefits, Alfa-Bank

"Alpha card with benefits" promises to receive income up to 8% per annum, but only in the first 2 months after opening an account. It is produced and maintained free of charge.

- % on balance: up to 8%

- Issue: 0 rub.

- Service: 0 rub.

- Cash Back: up to 2% basic, up to 30% from partners

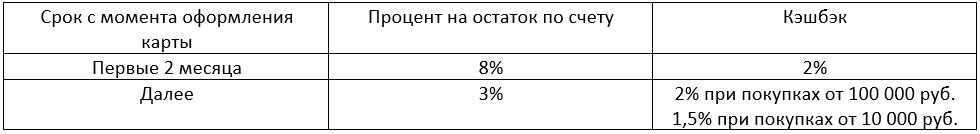

- Excerpt from tariffs for the "Alfa-Card with benefits" card (actual as of 11/15/2021)

"Alfa-Card with benefits" from Alfa-Bank really has many advantages, for which it is chosen by numerous clients of this credit institution. Plastic is not only produced, but also serviced free of charge without any additional conditions. There is also a cashback for all purchases with expenses from 10,000 per month, its monthly amount cannot exceed 5,000 rubles. Interest on the card balance is charged only on the amount not exceeding 300,000 rubles, but its amount is up to 8% per annum. There is only one nuance, but a very significant one. You can count on such a high percentage only in the first two months, then it will be 3%, which is also not bad, but not so impressive. For amounts over 300,000 rubles.interest is not charged at all.

- Up to 8% income

- 0 rubles for issue and maintenance

- Profitable cashback

- Cash withdrawal without commission

- High percentage of income only for the first 2 months

- Interest on the balance up to 300,000 rubles.

Top 9. Evolution, Ak Bars

Evolution will allow you to receive 5% annual income on your card account with a balance of 30,000 rubles or more, as well as accumulate "Universal Miles" to save on travel.

- % on the balance: up to 5% per annum

- Issue: 0 rub.

- Service: 0-79 rubles / month.

- Cash Back: up to 1.25%, up to 45.5% from partners

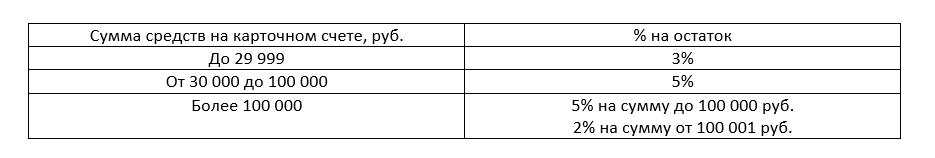

- Extract from the tariffs for the Evolution card (actual as of 11/15/2021)

The Evolution debit card from Ak Bars Bank will appeal to those who like to travel profitably. It allows you to earn "Universal Miles", which are later used to pay for train or plane tickets, as well as hotel stays. Issuing a card is free, but only those who spend at least 20,000 rubles on it within a month will not be able to pay for services. or replenish the balance in the amount of 10,000 rubles. Income can be up to 5% per annum, but only with a balance of 30,000 to 100,000 rubles. If the amount on the card account is more or less, interest will also be charged, but not as high. You can order the issue of plastic on the bank's website, where detailed conditions of the bonus program and other nuances of this offer are presented.

- Up to 5% per annum

- Interest is calculated regardless of the amount on the accounts

- 0 rubles for issue and maintenance (subject to conditions)

- High cashback from partners

- Low base cashback

Top 8. Benefit, Home Credit

The “Benefit” card is up to 5% per annum with expenses from 30,000 rubles. and 5% cashback on three selected categories.

- % on balance: up to 5%

- Issue: 0 rub.

- Service: 0 rub.

- Cash Back: 1% basic, up to 5% in three selected categories, up to 30% from partners

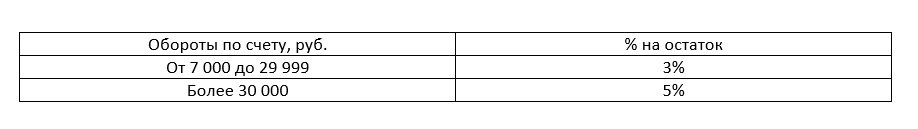

- Excerpt from tariffs on the “Benefit” card (actual as of 11/15/2021)

The Polza debit card from Home Credit Bank is issued and serviced free of charge without any conditions and restrictions. Another of its advantages is the possibility of receiving 5% on the account balance, but this will only be available if the monthly expenses exceed 30,000 rubles. Interest is charged only on amounts up to 300 thousand rubles. The basic cashback is small, only 1%, but for the three categories chosen by the client it is up to 5%, which is already quite good. There is also a cashback from partners in the amount of up to 30%. You can apply for a “Benefit” card both at the bank’s offices and online on the website. If necessary, it will be delivered by courier free of charge.

- Always 0 rubles for registration and service without conditions

- Up to 5% per annum

- 5% cashback on three selected categories

- Online registration + delivery by courier

- % only for an amount not exceeding 300,000 rubles.

Top 7. It's time, Ural Bank for Reconstruction and Development

"It's time" will allow you to receive an income of 6% per annum with monthly expenses from 60,000 rubles. and 6% cashback when spending from 25,000 rubles. and more.

- % on balance: up to 6%

- Issue: 0 rub.

- Service: 0-99 rubles / month.

- Cash Back: up to 6%

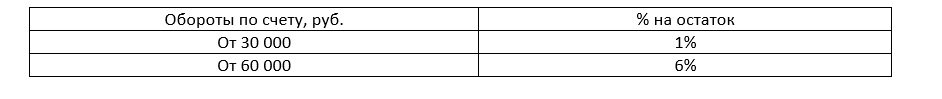

- Excerpt from tariffs for the Pora card (actual as of 11/15/2021)

UBRD offers private clients a profitable cashback and up to 6% on the account balance when opening a Pora card.It is issued for free, but in order not to pay 99 rubles a month for maintenance, you will have to spend at least 15,000 rubles or maintain at least 100 thousand rubles on all bank accounts. With interest on the balance of the account, there are also nuances. You can count on the maximum 6% when spending at least 60,000 rubles, and they will be charged only for 300,000 rubles. Everything is not easy with a high cashback, which in the amount of 6% will be received only by those who spend more than 25,000 rubles. and for purchases in certain categories. With active use of the card, as well as spending in categories that offer increased cashback, it can be very profitable.

- 0 rubles for issue and maintenance (subject to conditions)

- High cashback and percentage of income

- Online application for a card

- Service 99 rub. per month if conditions are not met

- Cashback on high spending in certain categories

Top 6. Maximum+, OTP Bank

"Maximum+" will allow new clients of OTP Bank to receive 10% on the account balance. The offer is limited.

- % on the balance: up to 10% (promotion until 12/31/2021)

- Issue: 0 rub.

- Service: 0-299 rubles / month.

- Cash Back: up to 10%

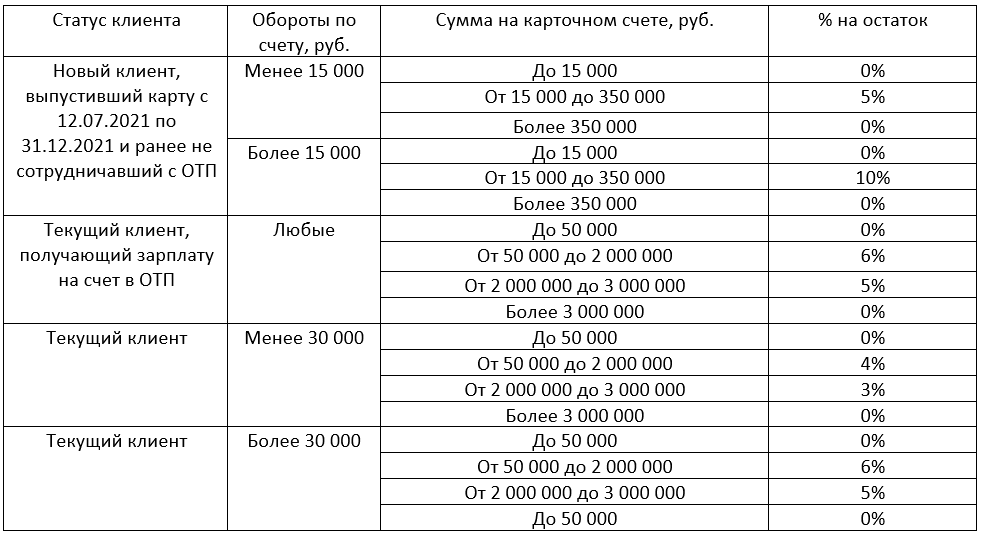

- Extract from the tariffs for the "Maximum +" card (actual as of 11/15/2021)

The "Maximum+" card from OTP Bank is attractive, first of all, for new customers who have not previously cooperated with this credit institution. For them, the bank is ready to offer exclusive conditions, namely, an income of 10% per annum (the promotion is valid until 12/31/2021).The rest can also count on receiving income, but it will be no more than 6% per annum and only if a certain list of conditions that are not the most favorable for most is fulfilled - with a turnover of 30 thousand rubles and maintaining a balance of at least 50 thousand rubles. The "Maximum+" card also attracts with the opportunity to receive a cashback of up to 10%, which is valid for purchases in three categories - pharmacies, clothing and footwear, children's clothing.

- 0 rubles per issue

- Cashback up to 10%

- Income up to 10% (until 12/31/2021)

- Free service (subject to conditions)

- Service 299 rubles per month if the conditions are not met

Top 5. Green World, Post Bank

Having issued a "Green World" for a teenager over 14 years old and putting on it from 100,000 to 1,000,000 rubles, you can receive 7.5% of annual income.

- % on balance: up to 7.5%

- Issue: 500 rubles.

- Service: 0-69 rubles / month.

- Cashback: no

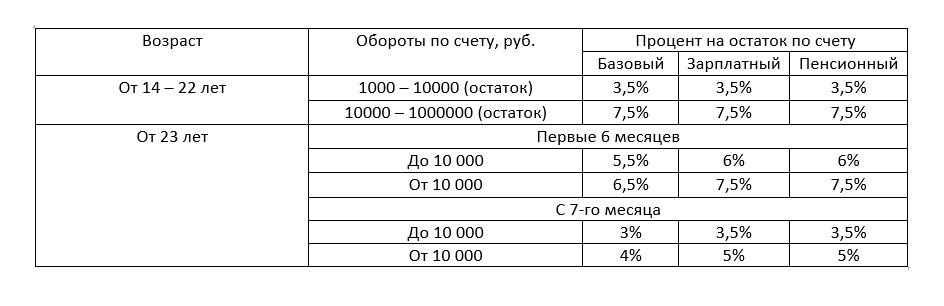

- Extract from the tariffs for the Green World card (actual as of 11/15/2021)

The Green World card from Post Bank allows not only to receive income in the form of interest on the balance, but also to become a participant in a charity event. For every 4,000 rubles that will be spent on this card, the bank will plant one tree, and the client will receive a certificate with an individual number and coordinates of the forest. The maximum percentage on the account balance reaches 7.5%, but it is not available to everyone. The final conditions depend on a number of factors - the tariff plan, the age of the client, the time since the opening of the account, the turnover on the account, as well as the status of the client. Monthly maintenance costs 69 rubles, but with expenses from 5,000 rubles. it will be free.

- Up to 7.5% per annum of income

- Always 7.5% of income for honorary clients

- The card can be opened from the age of 14

- Participation in a charity program

- No cashback and bonuses

- Paid Edition

- Paid service for turnovers less than 5,000 rubles.

Top 4. Maximum income, Loko-Bank

The "Maximum Income" card allows you to receive up to 6.5% on funds up to 5,000,000 rubles, which significantly exceeds the attractiveness of competitors' offers.

- % on balance: up to 6.5%

- Issue: 0 rub.

- Service: 0-499 rubles / month.

- Cash Back: 1% for everything, up to 25% for purchases from partners

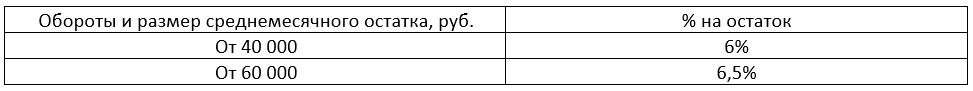

- Excerpt from tariffs on the "Maximum Income" card (actual as of 11/15/2021)

The "Maximum income" card from Loko-Bank offers one of the simplest and most understandable conditions for clients to receive income. Everyone who spends more than 60,000 rubles per month receives 6.5% per annum on it. and will maintain a minimum balance of the same amount. With expenses and the amount in the account from 40,000 rubles. income will be 6%, which is also quite good. Interest is charged in the amount of up to 5 million rubles, for most other banks it is several times lower. The card is issued free of charge, serviced free of charge subject to expenses and an average monthly balance of 40,000 rubles or more. If these conditions are not adhered to, then you will have to pay 499 rubles for the service. per month. But the SMS-informing service is always free and for everyone. Cashback is small, only 1%.

- Up to 6.5% on balance

- % for up to 5 million rubles.

- 0 rubles issue and maintenance (subject to conditions)

- SMS informing without charging a fee

- Small cashback

- Expensive service if conditions are not met

See also:

Top 3. Bought-Accumulated, Tavrichesky Bank

"Bought-Accumulated" will allow you to receive income up to 8% per annum, but only when spending more than 30,000 rubles. per month.

- % on balance: up to 8%

- Issue: 0 rub.

- Service: 0 rub.

- Cashback: no

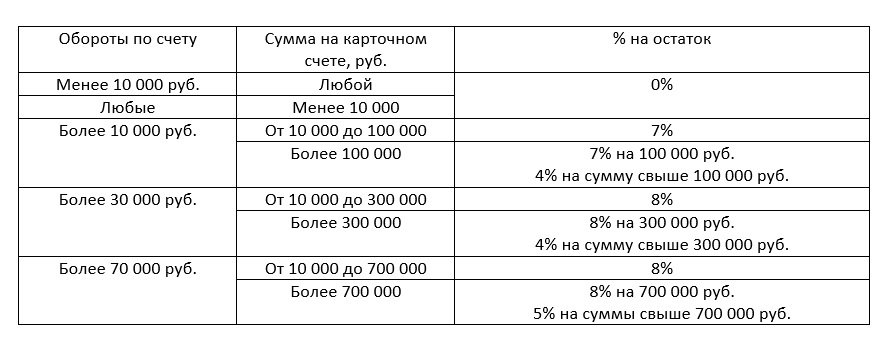

- Excerpt from tariffs on the “Bought-Accumulated” card (actual as of 11/15/2021)

The Bought-Accumulated card from Tavrichesky Bank is issued and serviced free of charge, which can be considered a serious plus, especially considering the fact that it is offered to customers in two premium versions of Visa Gold or Mastercard Gold. The card offers one of the highest interest rates on a balance of up to 8% per annum, however, to receive such a rate, several conditions must be met, namely, to maintain an average monthly balance, as well as a spending level of at least 10,000 rubles. Also, the final percentage depends on the amount stored on the card account. Among the shortcomings, one can note the lack of cashback, as well as the fact that the bank has a very small regional network. You can order plastic on the website, pick it up at the branch. Muscovites can get a card with the help of a courier.

- Up to 8% per annum

- Premium format Visa Gold or Mastercard Gold

- 0 rubles issue and maintenance

- Bank branches not in all regions

- No cashback

See also:

Top 2. Tinkoff Black, Tinkoff

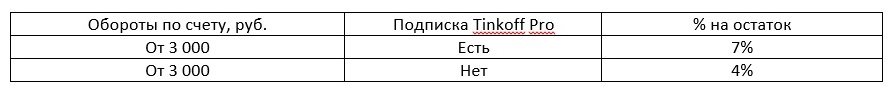

According to Tinkoff Black, it is as simple as possible to understand the conditions for obtaining a high 7% per annum - expenses of more than 3,000 rubles. + amount up to 300,000 rubles. + Tinkoff Pro subscription.

In the three selected categories, Tinkoff Black owners will be able to receive up to 15% cashback, which is higher than that of other credit institutions.

- % on balance: up to 7%

- Issue: 0 rub.

- Service: 0-99 rubles / month.

- Cash Back: 1%, up to 15% in 3 categories, up to 30% with partners

- Excerpt from the tariffs for the Tinkoff Black card (actual as of 11/15/2021)

Tinkoff Black is a popular debit card, the use of which offers a number of benefits for its owner. Plastic can be ordered free of charge and received within 1-2 days by courier. It will also be serviced free of charge, but only if the client of the bank has a loan or a permanent balance on all accounts from 50,000 rubles. Income can be up to 7% per annum, but such conditions can only be counted on when spending from 3,000 rubles. and the presence of a Tinkoff Pro subscription, the cost of which is 199 rubles. per month. The rest will receive 4% per annum with an amount not exceeding 300 thousand rubles. The standard cashback is small, but for 3 selected categories it can be up to 15%.

- Up to 7% income

- 0 rubles release and delivery by courier

- Free service subject to conditions

- Interest is accrued on an amount not exceeding 300 thousand rubles.

- To get a high%, you need an additional paid subscription

See also:

Top 1. Profit, Uralsib

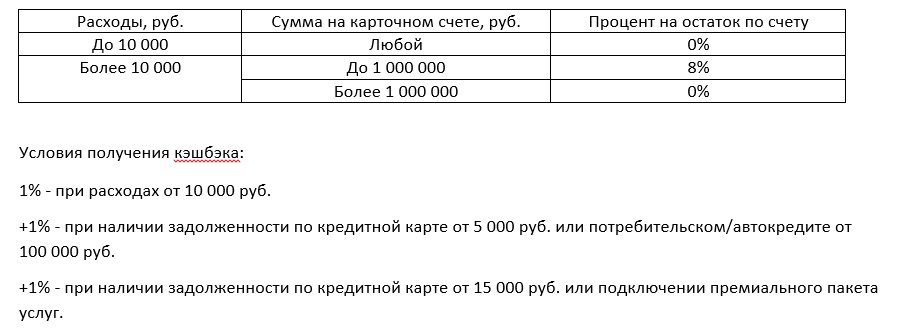

The Profit card from Uralsib can rightfully be considered the most profitable, since it allows you to receive 8% per annum on the card account balance up to 1,000,000 rubles. subject to expenses from 10,000 rubles.

- % on balance: up to 8%

- Issue: 0 rub.

- Service: 0-99 rubles / month.

- Cash Back: up to 3%

- Extract from the tariffs on the "Profit" card (actual as of 11/15/2021)

The Profit debit card from Uralsib Bank can become an indispensable financial assistant for those who actively use non-cash payments.It is issued free of charge, you can order it online, and get it at the bank office or with courier delivery. Monthly making non-cash transactions on it in the amount of 10,000 rubles. and more, you can expect to receive 8% on the account balance. The same requirement is necessary for free service. At the same time, it is important that no more than 1,000,000 rubles are kept on the card account. If the amount is greater, then the interest on the balance will be zero. An additional nice bonus is a cashback of up to 3%, but not everyone can count on such%, for most it will be equal to 1%

- 8% of income with expenses from 10,000 rubles.

- Issuing a card online, receiving it at the office or by courier

- Receipt of an unnamed card on the day of application

- Cashback up to 3%

- Increased cashback only when using bank credit products

- Interest on the balance and free maintenance for spending from 10,000 rubles.

See also: