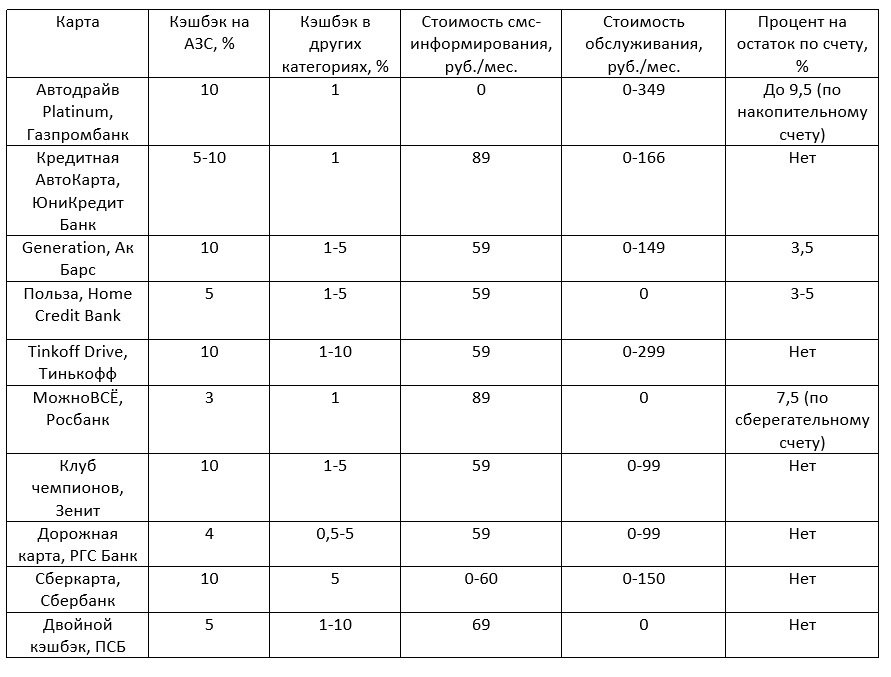

Place |

Name |

Characteristic in the rating |

| 1 | Tinkoff Drive, Tinkoff | The best cashback at gas stations, auto products and insurance |

| 2 | Sbercard, Sberbank | High cashback with appropriate spending |

| 3 | Favor, Home Credit Bank | Inexpensive service for a year. Exchange rate 1:1 |

| 4 | Roadmap RGS Bank | Stable cashback + roadside assistance program |

| 5 | Generation Ak Bars | Transparent conditions for bonus accrual. Own cashback service |

| 6 | CanVSE Rosbank | You can accumulate up to 10,000 bonuses monthly |

| 7 | AutoCard UniCredit Bank | Maximum compliance with the needs of motorists and travelers |

| 8 | Autodrive Platinum Gazprombank | Favorable status in the program from Gazpromneft. Additional fuel bonuses |

| 9 | Club Champions Zenith | The best for those who prefer Tatneft filling stations |

| 10 | Double cashback, PSB | Credit card with excellent cashback conditions |

When choosing a bank card that will allow you to receive a certain percentage of cashback at gas stations and will be able to partially or completely replace a fuel card, you need to pay attention to several points.It often happens that in order to receive a large return, certain conditions must be met, which are far from acceptable for everyone. In some situations, the amount of cashback may be limited, which automatically reduces its attractiveness. And it also happens that the bonus rubles accumulated under the loyalty program are not so easy to spend.

To participate in the rating, we tried to select debit and credit cards with the most transparent and most favorable conditions for accruing cashback at gas stations. Since the tariff policy of banks changes regularly, we recommend that you carefully read the current data on its provision and maintenance before making the final choice of a particular card.

Top 10 best bank cashback cards at gas stations

10 Double cashback, PSB

Cashback at gas stations: 5%

Rating (2022): 4.3

The Double Cashback credit card from Promsvyazbank can be more than convenient and profitable, offering decent return conditions for some purchases. Each of its owners has a choice of three packages of privileges, including “Auto”, which implies the possibility of receiving a 5% cashback at gas stations, 7% for maintenance and car washes, and 10% for paying traffic police fines. The return is credited to a special bonus account, you can accumulate no more than 2000 points per month. To get points, you need to spend more than 10,000 rubles a month.

The Double Cashback card is issued and serviced free of charge, has a credit limit of 15,000 to 1,000,000 rubles, and a grace period of 55 days. The interest rate is 21.5% per annum. Given the free service and quite a decent percentage of return, this card can be beneficial, but only if it is used wisely.

9 Club Champions Zenith

Cashback at gas stations: up to 10% (at Tatneft gas stations)

Rating (2022): 4.35

The Club of Champions debit card from Zenit Bank will be, first of all, the most profitable for those who regularly refuel at Tatneft gas stations, because it is for buying fuel at this network of gas stations that you can receive 10% cashback. It also gives an irreducible gold level in the Tatneft loyalty program, which provides an additional 3% bonus. The privileges for car owners do not end there. Refueling at any gas station, you can return 5% of the cost. 1% will be returned regardless of the place of spending.

Bonuses are accrued with a turnover of 10,000 rubles, and their maximum monthly amount is also tied to the amount of expenses. Spending up to 50,000 rubles. monthly, you can receive no more than 1000 bonuses, more than 50,000 rubles. - no more than 3,000 rubles. You can spend them at Tatneft gas stations, paying up to 100% of purchases (subject to depositing at least 1 ruble of your own funds), which makes this card in many ways similar to a fuel card, but with better functionality. For free maintenance of plastic, you need to spend at least 10,000 rubles. per month.

8 Autodrive Platinum Gazprombank

Cashback at gas stations: up to 10%

Rating (2022): 4.4

The Autodrive platinum card appeared in 2018 and since then its popularity among fans of fuel from Gazpromneft has only been growing. The narrow specialization of plastic is due to the fact that the highest percentages are charged for purchases at branded gas stations. For all other expenses, the bank will return 1 bonus from 100 rubles, which corresponds to 1%.Additionally, each new client receives 100 welcome bonuses + 50 bonuses every 3 months with regular refueling at Gazpromneft gas stations.

In addition, each cardholder receives an irreducible platinum status in the loyalty program of the gas station "On Our Way". It additionally allows you to accumulate bonus points - 2 bonus points for each liter of fuel, 1 bonus for 50 rubles of any purchases at gas stations. Bonuses received under the two programs are summed up and can be used to pay for fuel and other expenses on the territory of gas stations, equating to "live" rubles. An important condition is that you cannot receive more than 500 bonuses per month under the bank's loyalty program. At the same time, it is important to make purchases from 20,000 rubles. monthly outside Gazprom Neft filling stations. Under the “On Our Way” fuel program, you can accumulate up to 60,000 bonuses, their validity period is 12 months.

In order for the card to be discussed for free, you will have to spend on it every month from 35,000 rubles. + keep at least 100,000 rubles (there are other conditions). Otherwise, the fee will be quite high 349 rubles / month. By opening a savings account in addition to the card, you can receive income from it in the amount of up to 9.5% per annum.

7 AutoCard UniCredit Bank

Cashback at gas stations: up to 10%

Rating (2022): 4.45

Previously, "Autocard" from Unicredit was available in a debit version, now the bank offers it only as a credit card. However, the benefits for motorists still remain. Among them are not only a good credit limit (from 30 thousand to 3 million rubles).rubles) and cash back for expenses on gas stations, parking, carsharing, etc., but also discounts on car rental abroad, travel insurance, and participation in the Driver's Package program. The package includes a set of services that can help the driver in a critical situation on the road: refueling the fuel tank on the way (up to 20 liters), evacuation of the vehicle for a distance of up to 100 km within the coverage area, opening a blocked car.

Such assistance, which is also provided free of charge for purchases over 10,000 rubles, is highly appreciated by cardholders, and they do not consider a rather high interest rate – from 19.9 to 28.9% – to be a disadvantage. The amount of cashback depends on the volume of purchases on the card. With an amount of expenses from 50,000 rubles, it will be 5%, and if you spend more than 50,000 rubles, already 10%. 1% return can be received in all other categories. You can not pay for maintenance in the first year, then the fee will be 1990 rubles. annually.

6 CanVSE Rosbank

Cashback at gas stations: up to 3%

Rating (2022): 4.5

The debit card of Rosbank "MozhnoVSE" until recently was much more profitable and interesting, but even now it deserves attention and presence in the ranking of the best. The base cashback on everything is a modest 1%, but you can choose one category with a 3% return. It may well become the category of "gas stations and parking." For purchases from partners, you can return up to 20%. The maximum monthly cashback is limited to 10,000 rubles, which is more than some competitors.

From 10/01/2021 to 06/30/2022, there is a promotion according to which all issued cards will be able not to pay for its maintenance.By opening an additional savings account, you can earn up to 7.5%. Another interesting feature of the program is the possibility of earning points in miles to cover part or even the entire cost of a tourist package, subject to participation in the bonus program.

5 Generation Ak Bars

Cashback at gas stations: up to 10%

Rating (2022): 4.55

The results of a recent survey conducted by a major financial portal are rather disappointing: about 30% of Russians do not use banking products with cashback due to the lack of transparency of information about bonuses. Apparently, Ak Bars Bank took into account the realities of the market and, on its 25th anniversary, issued a Generation debit card with the most understandable conditions and one of the largest return percentages for the Transport category (which includes expenses for gas stations) and Entertainment: 10% and 5% respectively. The client is promptly introduced to the list of operations (MCS codes) for which cashback is credited, and they are also given a clear idea of what is not included in the bonus program.

At the same time, there is its own rate for converting cashback rubles into regular ones. If up to 2500 cashback rubles are spent for the operation, then only half of the amount is compensated in real rubles, and if more, then the ratio will be 1:1. The card is serviced free of charge with turnovers from 15,000 rubles. monthly, if the conditions are not met, the fee will be 149 rubles / month. Interest on the balance in the amount of 3.5% is charged with a card balance of up to 100,000 rubles. and with expenses on it 15,000 rubles.

4 Roadmap RGS Bank

Cashback at petrol stations: 4%

Rating (2022): 4.6

The debit "Road Card" from RGS Bank already says by its name that it can be beneficial for those who are often on the road. It provides for a good 4% cashback at gas stations, as well as a 5% refund for expenses in the “Auto” category, which includes spare parts, tolls and tolls, car washes, services and tire fitting. In addition, 4% will be returned for purchases in restaurants and the Entertainment category. To receive cashback, it is enough to spend more than 5,000 rubles on the card. monthly, and the refund amount cannot exceed 3,000 rubles.

In order not to spend money on plastic maintenance, it is necessary to maintain a monthly turnover of more than 10,000 rubles. At the request of the plastic holder, it is possible to connect several paid additional options. For motorists, the program "My Road" will be most interesting, within the framework of which for 155 rubles per month. you can get free legal advice, assistance in case of an accident, technical assistance and evacuation services.

3 Favor, Home Credit Bank

Cashback at gas stations: up to 5%

Rating (2022): 4.7

Many users consider this card to be the best banking product. Firstly, the bank is ready to compensate even 1%, but from all expenses, including utility bills, tours or car sharing. Cashback from gas station expenses can reach 5%, but only if you choose this category as one of the three that provide for an increased return. Some catch lies only in the fact that three categories of increased cashback must be selected monthly and it is not always possible to choose the most attractive category for the plastic owner.

Interest is accrued daily on the balance of funds up to 300,000 rubles.It will be 5% for card expenses from 30,000 rubles, 3% if you spend from 7,999 to 29,999 rubles. The card is always serviced free of charge, cash withdrawals and transfers are allowed up to 100,000 rubles. The amount of remuneration for the categories of increased cashback cannot exceed 3000 bonuses per month, there are no restrictions for other categories. 1 point = 1 ruble. The exchange is possible with the accumulation of 500 points.

2 Sbercard, Sberbank

Cashback at gas stations: 10%

Rating (2022): 4.8

A debit "Sbercard" from Sberbank will be especially beneficial for those who actively use plastic for settlements and payments, spend more than 75,000 rubles. per month or stores more than 150,000 rubles on the card. It is these conditions that must be met in order to receive a cashback of 10% at gas stations, as well as 5% for paying for a taxi and expenses in a cafe. For individual purchases from a number of partners, you can return up to 30% of expenses.

Such an offer may not be beneficial for everyone, but it will certainly have fans. Cashback is credited in the form of SberThanks bonuses, which can be exchanged for a discount of up to 99% of the payment amount. Spending only 5,000 rubles a month, you can not pay for plastic maintenance. The limits for withdrawing cash without a commission are quite high, but there is no interest on the balance on the Sbercard yet.

1 Tinkoff Drive, Tinkoff

Cashback at gas stations: up to 10%

Rating (2022): 4.9

The Tinkoff Drive debit card from Tinkoff Bank is ready to offer some of the best conditions for motorists. It implies the possibility of receiving 10% cashback not only for gas station expenses, but also 5% for all purchases in the Auto Goods category and the same amount for paying traffic police fines.This is definitely more profitable than using a fuel card of a certain gas station. In addition, 10% will be returned as bonuses for the purchase of any policy in Tinkoff Insurance and 1% for all other expenses.

The points received from cashback can be used to return money for purchases in the Auto Services category (1 bonus = 1 rub.) and for gas station expenses (1.5 bonuses = 1 rub.). There is also a cashback from partners, it can reach 30%, but there are usually few really interesting offers here. You can order a card on the bank's website, get it in 1-2 days by courier at home or at work. The issue is free, those who have a loan in Tinkoff Bank or will keep on the card from 50,000 rubles will be able not to pay for the service.

The main parameters of the cards participating in the rating